Whether you’re just starting your business or are already established, a business plan can help you plot your future. Additionally, a business plan is an opportunity to show why and how your business will become a success. Learning how to write a business plan successfully requires planning ahead and conducting financial and market research.

We provide a ton of information below to help you succeed in writing a business plan. However, if you find yourself struggling to create a plan, particularly the financial projections section, consider using a business plan software. LivePlan is a low-cost software that turns the complicated financial projections into easy-to-understand charts for your readers. Sign up with LivePlan for only $11.66 per month.

Here are the nine sections to include in your business plan:

1. Opening Organizational & Legal Pages

The business plan’s first pages help organize the rest of the business plan and legally protect your business idea. A cover page provides important information about the business. A non-disclosure agreement (NDA) is optional but may be necessary if you believe someone could steal your business idea or take strategies within your plan. The table of contents helps organize the entire business plan.

Cover Page

The cover page simply provides contact information about the business and its owner. On the cover page, include the business name and who prepared it, including your name, address, phone number, and email address. Additionally, if the registered company name with the state is different than the business name, you may want to add that as a “company name.”

Non-disclosure Agreement

A non-disclosure agreement (also called a confidentiality agreement) is a legal document that safeguards business information. You’d want someone to sign it before reading your business plan if you believe they could use the information to their advantage and your disadvantage, such as to steal your business idea or, something more focused, like a particular marketing strategy.

Fit Small Business provides a free non-disclosure agreement.

Table of Contents

The table of contents lists the sections and subsections of your business plan. All of the headers below (Executive Summary, Business Objectives, Company Summary, Products and Services, and so on) are considered sections of a business plan. You can number the sections for additional organization. For example, 1.0 is the executive summary, 1.1 is business objectives, and 1.2 is the mission statement.

2. Executive Summary

The executive summary is an overview of the business plan and should be no more than one to two pages in length. You may find that investors request only the executive summary. Make it an informative, persuasive, and concise version of your business plan. We recommend you complete the executive summary last, after completing the other sections in the business plan. Waiting to do this section last makes it easier to understand which sections of your business plan are the most important to highlight.

In the opening paragraphs of the executive summary, consider including the following:

- Business description: This is similar to a 30-second pitch describing your business and what makes it unique.

- Products and services: Mention the type of products and services you’re providing customers and their costs.

- Competitors: Briefly describe your biggest competitors and why your business will succeed despite them.

- Management and organization: Discuss the owners’ backgrounds and emphasize how it will help the business succeed. Also, if needed, discuss the management structure within the business.

- Business location (or facility): If the business’ location is important to its success, consider discussing the location benefits and the surrounding area.

- Target market and ideal customer: Outline who your ideal customers are and why they are going to purchase your products or services.

- Financial data and projections: Provide brief financial data and projections relevant to your business, such as startup costs, at what month the business will be profitable, and forecasted sales data.

- Financing needed: Wrap up the opening paragraphs with an explanation of the startup funding sources and the amount of financing being requested.

The bullets above can be combined into several paragraphs. Additionally, you can add or remove sections based on your business’ needs. For example, if you don’t have a physical location, remove that piece of information, or, if a web presence is crucial to your success, include two to three sentences on your online strategy. Remember, keep the executive summary, including the three headers below, to less than two pages in length.

Business Objectives

Your business objections are specific and attainable goals for your business. For example, “Attract at least 80 customers per day within the first year in business” or “Generate a positive cash flow from operations with at least 15% net profit to sales.” You can include business financial goals as well. Create at least four business objectives organized by bullet point.

Mission Statement

The mission statement discusses the aim, purpose, and values of your business. It’s typically a short statement from one sentence to several sentences in length. You may find that your mission statement evolves as your business grows.

For example, Airbnb’s mission statement is “To live in the world where one day you can feel like you’re home anywhere and not in a home, but truly home, where you belong.” Additionally, Outback Steakhouse’s mission statement is “We’re the leader of the pack by emphasizing consistently high quality delicious food delivering a warm, welcoming environment. Our generous portions are moderately priced. Our casual atmosphere couldn’t be more transporting—it’s like you’re right there in the Australian Outback.”

Keys to Success

Your keys to success are the specific advantages your business will have. For example, if your location is a huge advantage for your business, you should be more specific than simply saying “location,” and describe what about your location makes it a key to success, such as visibility, parking spots, drive-thru, or proximity to housing. Your competitors may have similar keys to success as your business.

Keys to success are different than competitive advantages because typically, the competitive advantage is something your competitors cannot replicate. It is a unique advantage or proprietary information, such as a patent. The competitive advantage can be added as a key to success. List two to three keys to success as bullet points.

3. Company Summary

Overall, the company summary section highlights your company successes (if you’re already in business) or why it will be successful (if you’re a startup). In the opening paragraph or paragraphs, provide facts about the business such as location, owners, hours, products, and services.

Startup Summary (or Company History)

How you structure this section depends on whether you’re a startup or an established business. A startup will discuss the general expenses and steps needed to open the business, such as permits, build-outs, rent, and marketing. An established business will briefly discuss the company’s financial performance over the past three years.

Startup Funding Table

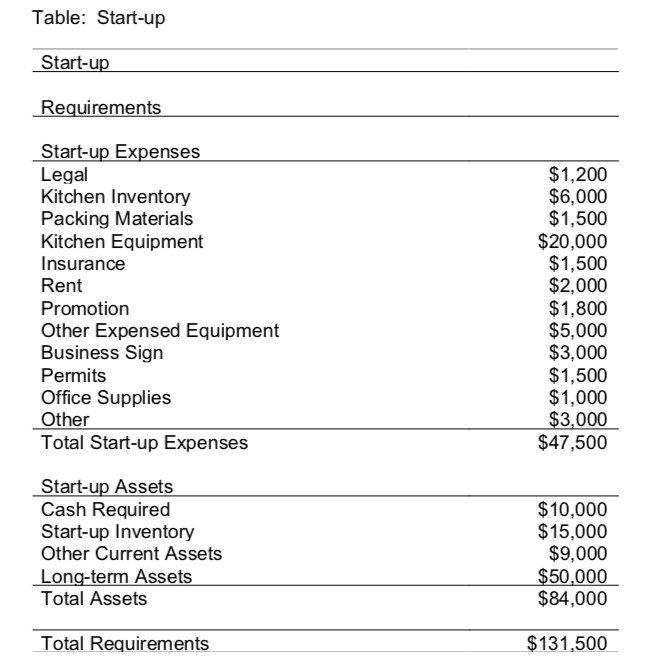

If you’re writing a business plan for the purpose of raising capital from an investor or bank, include a chart listing the items that will be purchased with the capital. For example, if you’re purchasing equipment with the additional funding, list each piece of equipment and the associated cost. At the bottom of the chart, show the total of all expenses, which should be the requested amount of funding.

This startup cost table for a pizza restaurant separates startup expenses from startup assets.

Location & Facilities

If you have a brick-and-mortar location or a facility, like a warehouse, describe it here. Go into detail about the benefits of your location and the surrounding areas. For example, write about square footage, leases or ownership, the surrounding area, and a brief description of the population.

Company Ownership

Briefly mention the company ownership team and their backgrounds. Show why these owners are likely to be successful operating this business by providing information such as each owner’s industry experience, previous employers, education, and awards won. This owner’s background will be discussed more in-depth in the management and organization section below.

Competitive Advantage

Ideally, your competitive advantage is what your business can do that your competitors cannot. It’s the one big feature that will make your company successful. Many investors are looking for specific competitive advantages, such as patents, proprietary tech, data, and industry relationships. However, if you don’t have these, describe the number one thing your business will do better than competitors, such as quality of products, quality of services, relationships with vendors, or marketing strategy.

4. Products & Services

The products and services section is the most flexible section because its structure depends on what your business sells. Regardless of what you’re selling, include a business model, which describes how your business makes money. Also include future products or services that the business may provide one, two, or five years down the road.

Business Model

The business model is essentially how the business makes money. If you have a new type of business or a novel way to produce a product or service, this section is important and needs to be in-depth. For example, if you own a pizza restaurant, you should discuss all the ways your business will earn money. Customers can order at a table inside your restaurant, over the phone, on your website, and using an app like Uber Eats. You may even be able to sell your homemade ranch bottles as well.

Products

If you have physical products you’re selling, describe them in this section. Remember to place an emphasis on both product features and benefits. For example, if you’re selling umbrellas, you could describe that they’re made of nylon, metal, and plastic. A benefit is that they keep you dry from rain while being small.

Services

Here you’ll discuss services that the business provides. If your business provides both products and services, have both sections. Remember, services don’t have to be sold for a cost. For example, entertainment like live music or bar games may be a free service your business provides.

Fulfillment

Whether you’re selling products, services, or both, it’s important to discuss how each will be delivered. Describe how a service, such as a window installation, will be implemented. Where will the glass be purchased from, acquired, and how will the window be installed? If you’re selling products, how will the products be assembled, packed, and shipped?

Future Products & Services

If you plan to provide additional products and services after the initial launch, outline that here. Don’t limit yourself to providing more of the same product or service. For example, if you have a commercial photography company, you might make plans to hire a graphic designer to provide a different service. Additionally, you can describe how you’d like to expand your business, such as renting out the unit next door, to provide additional services or sell additional products.

5. Market & Industry Analysis

The market and industry analysis section is where you analyze your potential customers and your industry. This section is where you make the case as to why your business should succeed, ideally backed by data. You’ll want to do a deep dive into your competitors and discuss their challenges and successes. Remember, this section should be persuasive and make the case as to why your business will be successful.

Market Segmentation

Market segmentation is also called your business’ target market. It consists of the customers who are most likely to purchase your products or services. Describe these groups of customers based on demographics, such as age, income, location, and buying habits. Additionally, if you’ll be operating business-to-business (B2B), use characteristics to describe the ideal businesses to which you’ll be selling.

Once your target market is segmented into different groups, use market research data to show that those customers are physically located near your business (or are likely to do business with you if you’re online). You can obtain this data from a free resource, like the U.S. Census and ReferenceUSA, which is free at thousands of libraries across the United States. For example, if you are opening a daycare, you will want to show the data on how many families are in a certain mile radius around your business.

ReferenceUSA collects market research data from over 147 million U.S. citizens.

Target Market Segment Strategy

Once you have at least three segments created, briefly outline the strategy you will use to reach them. Most likely it will be a marketing strategy, although it may be a pricing, networking, or sales strategy. Additionally, describe the general thinking of the segments (or inner workings of the businesses) that would cause them to do business with you. For example, if you owned a restaurant next to a theme park, describe how families will want to visit your family-friendly restaurant after a long day at the theme park.

Industry Analysis

In addition to the target segments, analyze the business’ industry and explain why it’s a great idea to start a business in that industry. If you’re in a growing industry, a bank is more likely to lend your business capital because it’s predicted to be in demand and have additional customers. Find industry statistics from a free tool, like the Bureau of Labor Statistics, or a paid tool like the Hoovers Industry Research, which provides professionally curated reports for over 1,000 industries.

Competitor Research

Wrap up the market and industry analysis section by analyzing at least five competitors within a five-mile radius (expand the radius, if needed). Create a table with the five competitors and mention their distance from your business (if applicable), challenges, and successes. During your analysis, you’ll want to frame their challenges as something you can improve upon. Persuade your reader that your business will provide superior products and services than the competitors do.

6. Marketing Strategy & Implementation Summary

The marketing strategy and implementation section is where you outline your marketing strategy and how it will be carried out. In the opening paragraphs, give an overview of the subsections below. For some businesses, this section may be longer than others. For example, a business relying on ecommerce for sales may outline the website, social media strategy, online advertising, and email marketing strategy. For a company relying on government contracts that won’t do a lot of marketing, this will be a shorter section.

Marketing Strategy

Discuss the overall marketing strategy for the business. Include any trends within the industry you may take advantage of, such as video or Facebook ads. If applicable, include the advertising strategy and budget, stating specific channels. Mention who in the business will be responsible for overseeing the marketing.

Traditional Marketing Plan

Within the marketing strategy, you may want to include a subsection that includes the business’ traditional marketing plan. Traditional marketing includes anything not online-related, such as business cards, flyers, local media, direct mail, magazine advertising, and signage. For example, if you own a retail business, like a dog groomer, traditional marketing will most likely be a strong component of your business.

Online Marketing Plan

An online marketing plan (also called web plan) includes using tools like the business’ website, social media, email marketing, and video, and may require several pages. If you’re hiring a company to do any online work, like creating a website or managing social media, briefly describe them and the overall cost (you can elaborate more on costs in the financial data section).

Sales Strategy

If sales is an important component of your business, include a section about your strategy. Include the role of the salesperson (or persons), strategies they will use to close the deal with clients, lead follow-up procedures, and networking they will attend. Additionally, discuss any training your sales staff will attend.

Sales Forecast Table

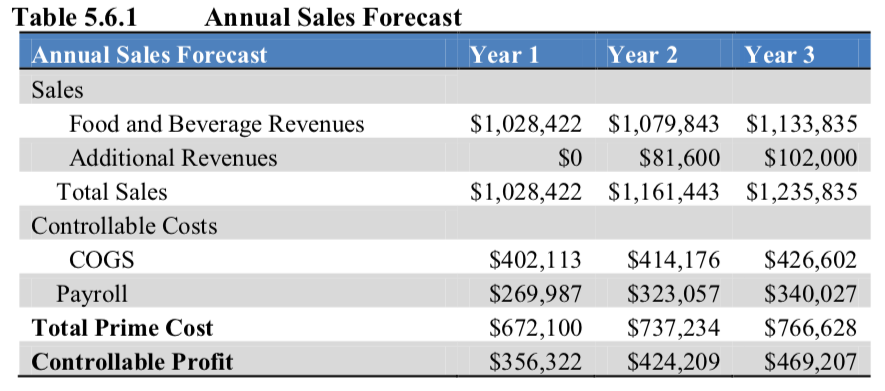

A sales forecast table gives a high-level summary of where you expect your sales and expenses to occur for each of the next three years in business. In the paragraph before the table, state where you expect growth to come from and include a growth percentage rate. The annual sales forecast chart will be broken down further in the financial projections section below.

The annual sales forecast for this restaurant summarizes sales, cost, and profit for the first three years in business.

Pricing Strategy

In the pricing strategy section, discuss product (or service) pricing, competitor pricing, sales promotions, and discounts—basically anything related to the pricing of what you sell. You should discuss pricing in relation to product and service quality as well. Consider including an overview of pricing for specific products, e.g., pizza price discounts when ordering a specific number of pizzas for catering.

Milestones

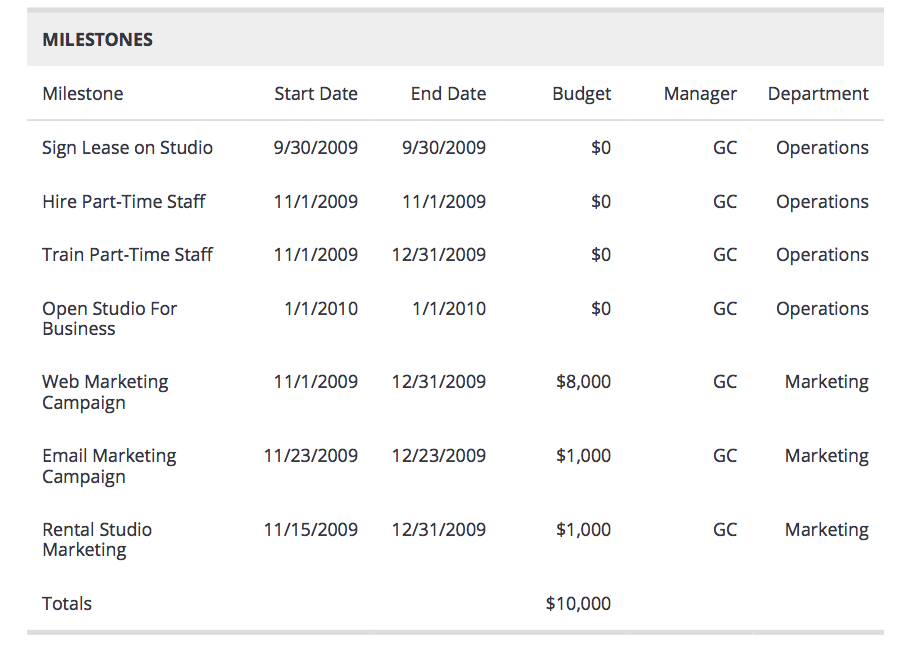

Milestones in a business plan are typically displayed in a table. They outline important tasks to do before the business opens (or expands, if already in business). For each milestone, include the name, estimated start and completion date, cost, person responsible, and department responsible (or outside company responsible). List at least seven milestones.

Milestones for this commercial photography business include hiring staff and completing marketing campaigns.

7. Management & Organization Summary

The management and organization summary discusses the ownership background and the personnel plan in-depth. This is an important section because many investors say they don’t invest in companies, they invest in people. In this section, make the case why you and your team have the experience and knowledge to make this business a success.

Ownership Background

Discuss the owners’ backgrounds and place an emphasis on why that background will ensure the business succeeds. For example, if you would like to open a sports and outdoors store, discuss your retail management experience. If you don’t have experience managing a retail business, consider finding a co-owner who does. Typically, banks won’t lend to someone who doesn’t have experience in the type of business they’re trying to open.

Management Team Gaps

If there are any experience or knowledge gaps within the management team, state them. List the consultants or employees you will hire to cover the gaps. Investors who know your industry well may recognize gaps within your business plan, and it’s important to state the gaps without having the investor bring it up. Recognizing any experience gaps makes it appear that you know the industry well.

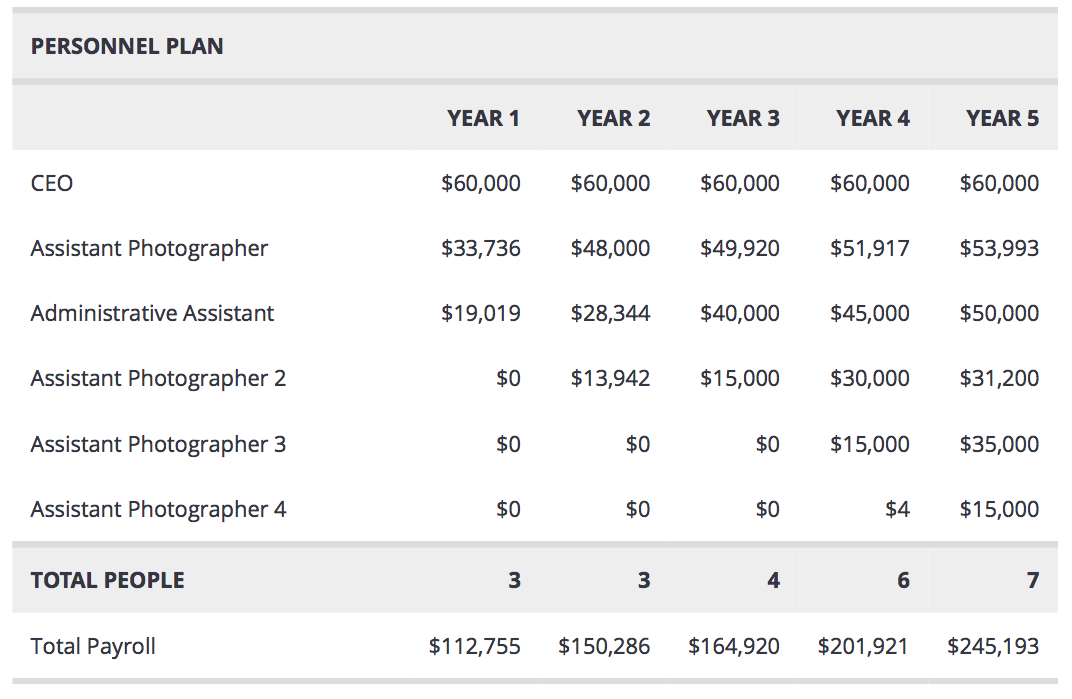

Personnel Plan

The personnel plan outlines every position within your business for at least the next three years. In the opening paragraph, discuss the roles within the company and who will report to whom. Include a table with at least three years of salary projections for each employee in your business. Include a total salary figure at the bottom. This table may be broken down further into salaries for each month in the financial projections or appendix.

This commercial photography business has the CEO at the same salary every year, with their employees’ salaries increasing year over year.

8. Financial Data & Analysis

The financial data and analysis section is the most difficult part of a business plan. This section requires you to forecast income and expenses for the next three years. Additionally, it requires a working knowledge of common financial statements, like the profit and loss statement, balance sheet, and cash flow statement.

As you read through the financial data sections below, use the free financial projections template from the Service Corp of Retired Executives (SCORE) to fill in your business’ information. If this is too challenging, we recommend using a business plan and financial projections software, like LivePlan, to assist with the forecasting.

In the opening paragraphs of the financial data and analysis section, give an overview of the sections below. Discuss the break-even point and the projected profit at the first, second, and third year in business. State the assets and liabilities from the projected balance sheet as well.

If you’re getting a loan from a bank, say how long and from what source the loan will be repaid. One of the main pieces of information bankers want to ascertain from financial forecasting is if they will be paid back and how likely that is to happen.

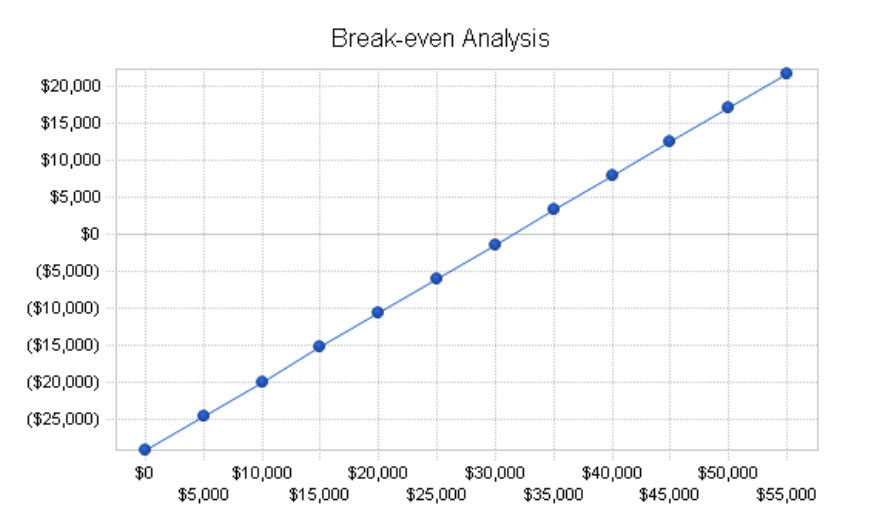

Break-even Analysis

The break-even analysis is the point at which revenue exceeds expenses and a profit occurs. In this section’s opening paragraph, state what the monthly fixed costs will be and what the average percent variable cost is, which is the cost that changes with output. For example, variable costs for the example below increase 8% for every additional dollar made.

The break-even point for this document shredding business is $31,500 in a month.

Projected Profit & Loss

The profit and loss table is a month-by-month breakdown of income and expenses (including startup expenses). The profit and loss table shows the month during which the business will earn a profit. Typically, you should expect your business to show a profit within the first year of operating and increase in years two and three. Be sure to show income and expenses month-by-month for the first two years in operation. Create a separate chart that shows income and expenses year-by-year for the first three years.

Projected Cash Flow

The cash flow section shows the business’ incoming and outgoing cash. This is broken down in a month-by-month table and should cover the first two years in business. Projected cash flow is different than the profit and loss projection, because it focuses specifically on cash within the business. Cash flow is important because you want cash on hand to meet repayment obligations and unexpected cash needs.

In this section’s introductory paragraph (before the projected cash flow table), mention what you plan to do with the excess cash. For example, will you pay down long-term debt, build cash contingency reserves, or reinvest in certificates of deposit or U.S. Treasuries?

Projected Balance Sheet

The balance sheet shows the net worth of the business and the financial position of the company on a specific date. The balance sheet is different than the profit and loss statement because it focuses on the assets and liabilities of the business. The profit and loss statement focuses on income and expenses. Ideally, the balance sheet should show that the net worth of your business increases. Prepare a projected year-by-year balance sheet for the first three years.

Business Ratios

Business ratios (also called financial ratios) are a way to evaluate the performance of your business. It’s helpful to compare your projected business ratios to the industry standard. LivePlan provides business ratios for over 1,000 industries with its paid plan. Project your business ratios by year for the first three years.

For example, you should know your business’ current ratio, which is the total current assets (cash and other assets that can be liquidated easily) to total current liabilities (short-term debts due in less than a year). If you have $2,000 in current assets and $2,000 in current liabilities, your current ratio would be 1:1.

A 1:1 current ratio means for every $1 of current assets on the books, your business has $1 of current liabilities. Anything below a 1:1 could indicate your business will not be able to pay its debts, which would be a red flag to lenders and investors.

9. Appendix

The appendix is where you put information about a business that doesn’t fit in the above categories. What you put here largely depends on the type of business you’re creating. A good recommendation is to put any visual components in the appendix. For example, if you are opening a restaurant, consider adding a menu and an artist rendering of the interior and exterior.

Consider including the following items in your business plan appendix:

- Building permits

- Artist mock-up of interior

- Floor plan

- Leases and agreements

- Equipment documentation

- Supplier agreements

- Incorporation documents

- Licenses and permits

- Trademarks

- Media coverage

- Marketing materials

- Letters of recommendation

An appendix is not required in a business plan, but it is highly recommended for additional persuasion. Often, documents like media coverage, agreements, and equipment documentation show the investor and banker you’re serious about the business. If your appendix becomes too long, more than 10 pages, consider creating a second table of contents placed before the appendix.

Detailed Financial Projections

The financial projections in the previous section is typically a year-by-year breakdown for three years in the future. However, bankers and investors want to see the first two years broken down month-by-month for at least the profit and loss statement, balance sheet, cash flow, and personnel plan. Put the more detailed projections in the appendix. Typically, you can simply print out the Excel sheet in smaller font and include in the appendix. You don’t need to create additional charts for the appendix.

Frequently Asked Questions (FAQs) About How to Write a Business Plan

This section includes the most frequently asked questions about how to write a business plan. If you don’t see your question, head over to our forum and post your question there. We have a whole team of industry experts who answer questions from small business owners every day.

What needs to be in a business plan?

What you should put in a business plan depends on its purpose. If you’re seeking funding from a bank or investor, you’re going to need most of the sections above. However, if you have time to only do one section, it’s the financial projections. Your research and company information are great, but investors and bankers want to read your financials first. The research involved to determine the forecasted numbers takes a lot of time, but it will help you prepare for the business’ launch.

How do you write a business plan for a startup?

The business plan for a startup is similar to a business plan for an established business. The startup business plan will include startup costs, which will be listed by item and factored into the financial projections. Additionally, since your business hasn’t proven it can be successful yet, you may need additional information about the ownership, business model, market, and industry to convince the reader your business will succeed.

How long does it take to write a business plan?

A simple business plan may only take a couple hours. However, for the business plan provided with this template, which includes financial projections, it may take over 60 hours to research the income and costs associated with running your business. Additionally, you have to format those costs into a chart; it’s a best practice to showcase the data with easy-to-understand charts.

Is writing a business plan hard?

Yes, creating a business plan for funding from a bank or investor is hard. Unless you have a background in financial statements, the financial projections are difficult for the average business owner. If you want to create a more simple business plan than the one presented here, consider a business model canvas (BMC); it’s a more modern business plan and can be finished more quickly.

Bottom Line

Every type of business, whether it’s a side hustle or a multimillion dollar business, needs to have a business plan. The industry analysis and market segmentation sections validate your business idea. Researching and forecasting financial projections helps logically think through income and expenses, which lessens the risk of business failure. Remember to get feedback on your business plan from business employees and associates. If necessary, have them sign an NDA before they review the plan.

The above information, including the financial projection template from SCORE, provides plenty of information to create a business plan worthy of investment. However, many business owners struggle with the financial projections and need additional assistance. LivePlan is a business plan software that provides step-by-step directions for the plan and financial projections. Additionally, LivePlan takes the information entered into financial tables and creates easy-to-read charts. Sign up to get started with LivePlan today for only $11.66 per month.

Read More

0 تعليقات