Starting a business can be a dream come true. As it turns out, you don’t need a degree from Harvard University to do it. If you’re curious about what it takes to have a successful startup, look no further, dear entrepreneur; we’ve compiled some startup statistics that may surprise you.

I. Analysis

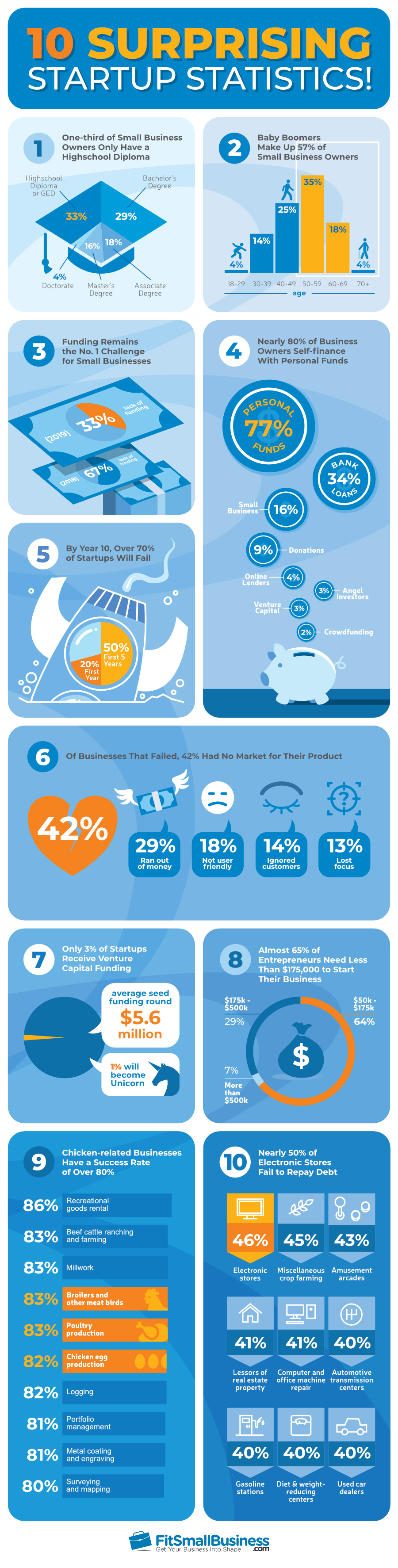

Here are the 10 most surprising startup statistics.

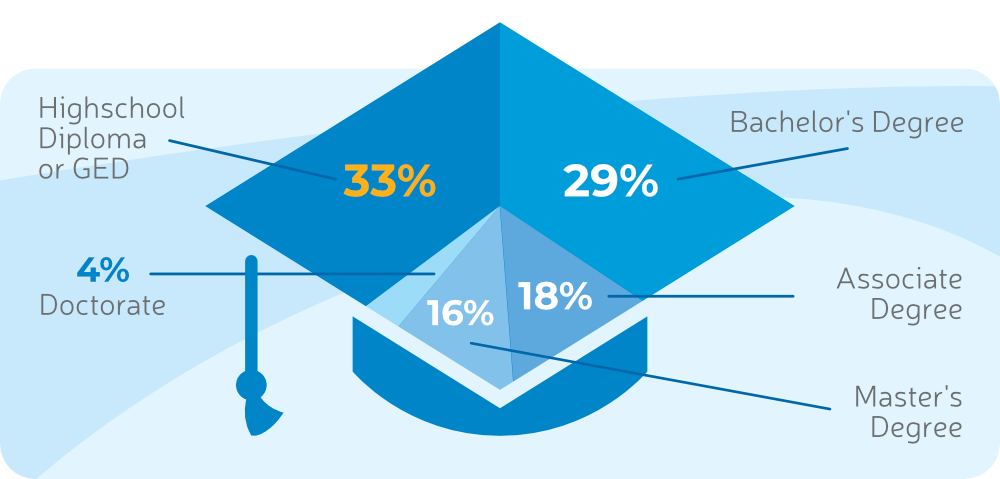

1. One-third of Small Business Owners Only Have a Highschool Diploma1

- 33% have a high school diploma or GED

- 29% hold a bachelor’s degree

- 18% of small business owners have an associate degree

- 16% earned a master’s degree

- 4% completed their doctorate

Before you head off to pursue a degree in business, it’s important to know that 33% of owners started their small businesses with just a high school diploma or GED equivalent. Cumulatively, however, the majority of entrepreneurs— 67%—have some form of higher education.

Regardless of education level, roughly 70% of small business owners reported profitability in 2018. While we aren’t saying that you should forego higher education in hopes of starting your own business, these startup statistics do indicate that your level of education is not the key to startup success.

2. Baby Boomers Make Up 57% of Small Business Owners1

- 35% of small business owners are between the ages of 50 and 59

- Those aged 40 to 49 make up 25% of small business owners

- Entrepreneurs aged 60 to 69 make up 18% of all small business owners

- Small business owners age 30 to 39 equal 14% of the group

- Only 4% of small business owners are between the ages of 18 to 29

- 4% of small business owners are age 70 or older

Despite the millennial generation being similar in size to that of the baby boomers, the more—ahem—experienced group makes up over half of all small business owners. While millennials are innovative, they are also cautious, making them less apt to take the risk of starting their own business. Meanwhile, many baby boomers have reached or are nearing retirement age, and some are beginning second careers as entrepreneurs.

An additional hurdle for millennials is that most small business financing requires collateral—a home or significant retirement savings—that most have yet to acquire. Homeownership among the millennial cohort is 8 percentage points less than it was for Gen Xers at the same age2.

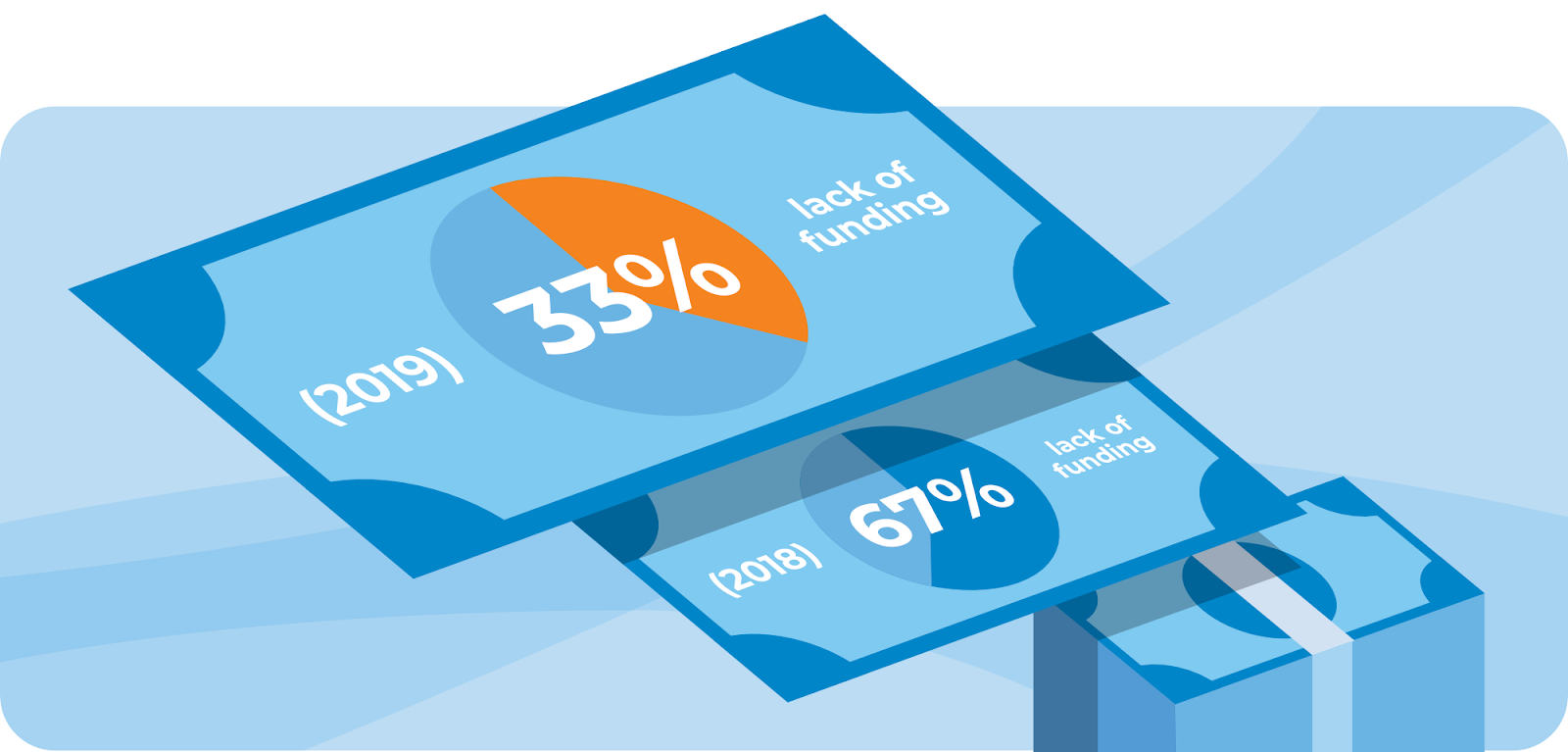

3. Funding Remains the No. 1 Challenge for Small Businesses1

- 33% of small businesses lack capital and cash flow

- That’s down from 2018 when 67% of small business owners reported a lack of capital3

Unfortunately, money doesn’t grow on trees, but small business owners would be overjoyed if it did. Finding startup funding can be tough, and one-third of small business owners say insufficient capital and cash flow is their top problem. While money is the biggest issue, small business owners also struggle with marketing, recruiting talent, and providing benefits for employees.

4. Nearly 80% of Business Owners Self-finance With Personal Funds4

- The majority of small business owners—77%—use personal funds to cover business expenses

- Bank loans only comprise 34% of the funding used by small businesses

- Family and friends provide 16% of small business loans and contribute another 9% through donations to the business

- Alternative online lenders are attributed to 4% of small business funding

- Personal investments from angel investors make up 3% of startup financing

- While there’s a lot of hype around venture capital, it only accounts for 3% of small business funding

- Crowdfunding raises 2% of the funding used by small businesses

Are you prepared to ask your parents for money? If not—and even if you do—you’re going to need to break open your own piggy bank. Entrepreneurs thinking about starting a business should be prepared to contribute their personal funds. Even small business owners that have access to other means of financing often find themselves having to open their personal wallets to cover business expenses. With less than 50% of businesses receiving external financing, the motto for small business owners seems to be bootstrap or bust.

If you’re worried your small business won’t become successful because you’re limited to using personal funds, take heart: Some of today’s well-known companies were funded entirely by the entrepreneur’s own savings. Spanx owner, Sara Blakely, started the company using $5,0005 of her personal savings in 2000. Today Spanx has a net worth of more than $1 billion and remains privately owned.

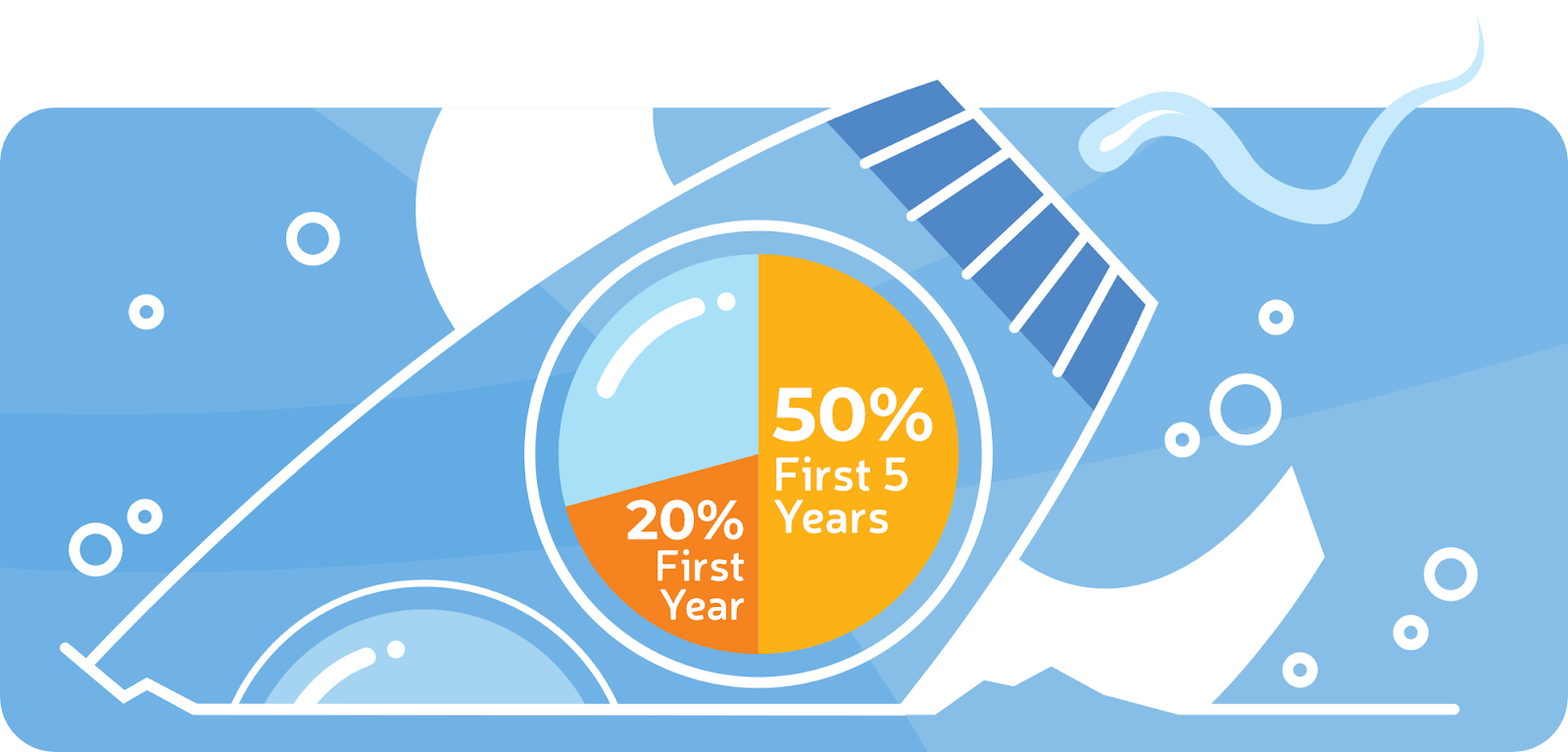

5. By Year 10, More Than 70%6 of Startups Will Fail

- 20% of startups fail in the first year

- 50% of startups fail in the first five years

The rate of startup business failure may seem alarming, but that doesn’t mean you should give up. While insufficient funding is detrimental to a business, it isn’t the top reason that startups fail. The No. 1 reason is a lack of understanding of the market they serve7 and failing to adapt to changing market needs.

Due to the importance of keeping tabs on your market, it’s a good idea to conduct a market analysis and realign your business to meet current consumer demands.

6. Of Businesses That Failed, 42% Had No Market for Their Product7

- 42% of businesses stated their failure was caused by a lack of market for their product

- 29% of business owners ran out of cash to run their businesses

- Having a product that wasn’t user-friendly led to the demise of 18% of businesses

- An alarming 14% of businesses failed because they ignored their customers

- 13% of small business owners simply lost focus in their endeavors

Financing and cash flow may be the No. 1 concern for small business owners but, as we mentioned, what they need to pay attention to is their market. A whopping 42% of businesses that failed reported that a lack of market need caused their demise. While additional funding may have prolonged their lives, these businesses perished due to a nonexistent customer base.

Among the other causes of failure were issues pertaining to competition, pricing and costs, products that weren’t user-friendly, and ignoring customers. The moral of the story here is that small business owners need to pay attention to their surroundings, understand the market and, you know, listen to the wants and needs of their customers.

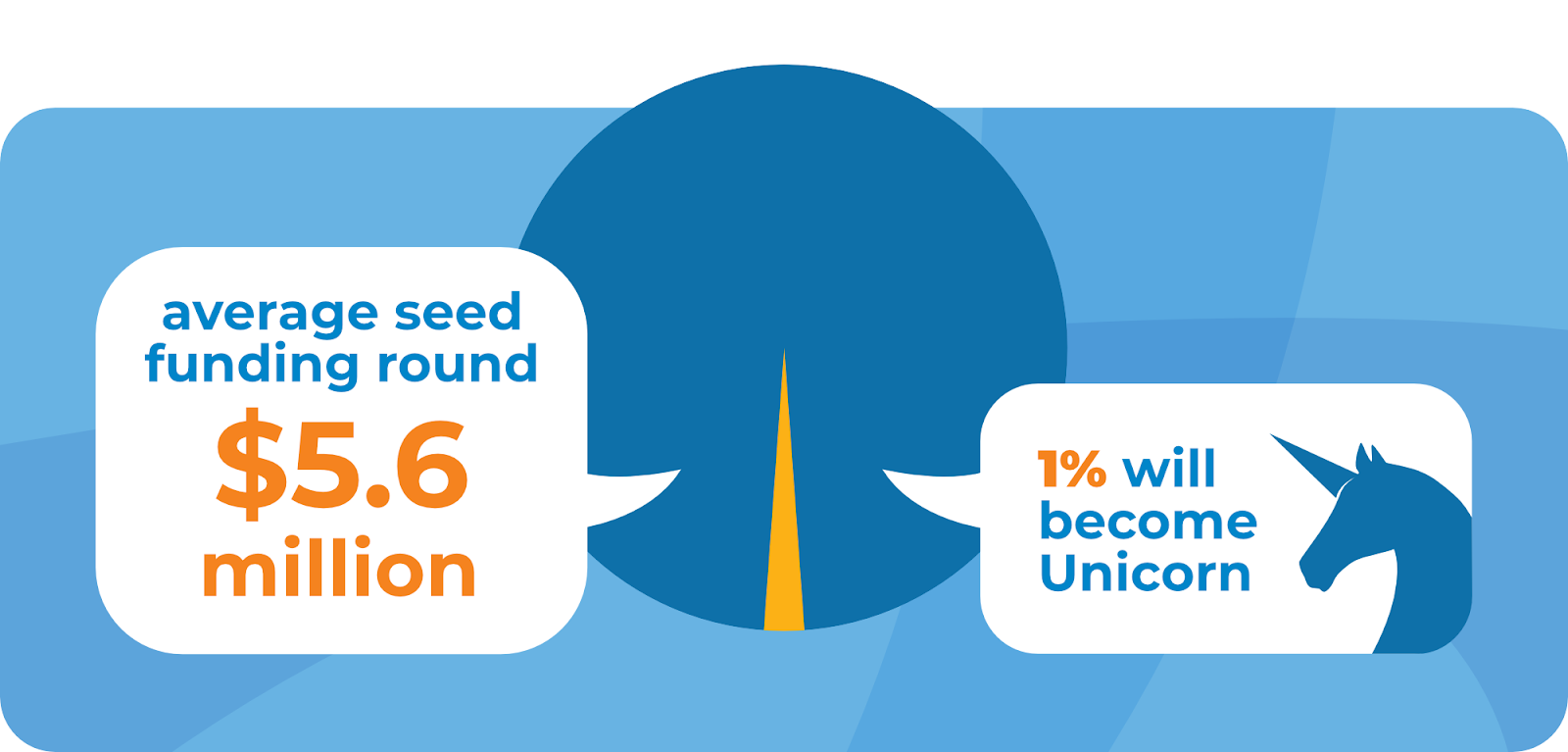

7. Only 3% of Startups Receive Venture Capital Funding1

- The average seed funding round is $5.6 million8

- Of those that receive venture capital funding, only 1% will reach unicorn status9

Dreams of unicorns are common among small children and entrepreneurs, and the odds of obtaining one are similar in both cases. You have a better chance of dating a millionaire than having your startup business reach unicorn status. The term “unicorn” is used in the world of venture capital to describe startups that reach a business valuation of $1 billion.

Of the thousands of startups that seek venture capital investors, only 3% are selected for funding. For those businesses selected, the $5.6 million they received during the average seed round can be a complete game-changer for their startup. However, despite this lofty initial investment, 75% of venture capital-backed businesses fail, and a mere 1% grow a horn and become a magical unicorn.

8. Almost 65% of Entrepreneurs Need Less Than $175,000 to Start Their Business10

- 64% estimate they will need $50,000 to $175,000

- 29% of entrepreneurs guess they’ll need $175,000 to $500,000

- 7% say they will need more than $500,000

How much money does it take to start a business? A majority of aspiring entrepreneurs say they could open their businesses if they had access to $175,000. But not all businesses are alike, and $175,000 is not the minimum amount needed in all cases. A home-based business, for instance, can be started for less than $5,000. Fit Small Business was started with roughly that amount.

9. Chicken-related Businesses Have a Success Rate of More Than 80%

- Recreational goods rental: 86% success rate11

- Beef cattle ranching and farming: 83% success rate

- Millwork: 83% success rate

- Broilers and other meat birds: 83% success rate

- Poultry production: 83% success rate

- Chicken egg production: 82% success rate

- Logging: 82% success rate

- Portfolio management: 81% success rate

- Metal coating and engraving: 81% success rate

- Surveying and mapping: 80% success rate

Looking for a successful business venture? Chickens—yes, the egg-laying fowl—may be your answer. Of the top 10 most successful industries based on Small Business Administration (SBA) loan repayment rates, chicken-related businesses account for three. Whether it’s raising chickens for meat production, operating a hatchery to sell chicks, or the commercial production of eggs, these businesses rule the roost.

However, if hanging out with chickens isn’t your idea of a fun business, the most successful industry is the rental of recreational goods. These businesses are generally seasonal in most locations and include rentals of such items as beach chairs and umbrellas, golf carts, ski and snowboard equipment, exercise equipment, and even yachts.

10. Nearly 50% of Electronic Stores Fail to Repay Debt

- Electronic stores: 46% failure rate11

- Miscellaneous crop farming: 45% failure rate

- Amusement arcades: 43% failure rate

- Lessors of real estate property: 41% failure rate

- Computer and office machine repair: 41% failure rate

- Automotive transmission centers: 40% failure rate

- Gasoline stations: 40% failure rate

- Diet and weight-reducing centers: 40% failure rate

- Used car dealers: 40% failure rate

Nearly half of the electronic stores that received SBA loans failed to repay them. For this nonachievement, electronic stores have been voted least likely to succeed. However, unlike those industries that proved to be most successful, there is no overarching theme among this group of more volatile industries.

Except for crop farming, all of these industries would be impacted by a significant downturn in the economy, which may have contributed to their ultimate failure. Furthermore, with electronic store giants like Circuit City declaring bankruptcy, it’s no surprise that small businesses in the industry struggle. As technology prices drop, so does the demand for repair as it’s often cheaper to just buy a new computer or printer than to repair an existing one. Who needs arcades when personal gaming systems offer instant access to hundreds of games.

II. Key Takeaways

So, what do these startup statistics tell us? That you don’t need fancy degrees or $1 million in the bank to get your business off the ground. Our key takeaways are:

- Don’t become part of the 13% of business owners that failed because they lost interest.

- Do plan on finding some sort of funding, a target market and, well, maybe some chickens.

- Do hold on to your dream, grab your unicorn by the horn and ride off to success.

III. Infographic

IV. Bibliography

- Guidant Financial. Current small business trends and statistics 2019. (2019).

- Choi, Jung Hyun. The state of millennial homeownership. (Jul. 11, 2018).

- Guidant Financial. 2018 Small business trends. (2018).

- King, Melanie. Small business owners: American dream is out of reach. (Sept. 27, 2018).

- Gonzalez, Guadalupe. 5 famous companies that bootstrapped their way to success. (June 6, 2017).

- Bureau of Labor and Statistics. Survival of private sector establishments by opening year. (2018).

- CBInsights. The top 20 reasons startups fail. (Feb. 2, 2018).

- Loizos, Connie. A quick look at how series A and seed rounds have ballooned in recent years, fueled by top investors. (Apr. 25, 2019).

- CBInsights. Venture capital funnel shows odds of becoming a unicorn are about 1%. (Sept. 6, 2018).

- Guidant Financial. Current trends and statistics for aspiring entrepreneurs. (2019).

- U.S. Small Business Administration. 2010 – present SBA 7(a) loan data. (2019).

Read More

0 تعليقات