Franchise financing is used to fund the purchase of a franchise or provide working capital to an existing franchise. The costs and terms associated with franchise loans vary by the type you choose. Small Business Administration (SBA) loans for franchises have interest rates from 7.75% to 10.25%, and loan terms of up to 10 years.

A rollover for business startups (ROBS) lets you utilize your retirement savings―401(k), individual retirement account (IRA), 403(b), and so on―without paying early withdrawal penalties and taxes to fund your franchise. If you have at least $50,000 in eligible retirement accounts, a ROBS can help you finance 100% of your franchise. Guidant, our recommended ROBS provider, offers a free initial consultation.

How Franchise Financing Works

Like any business loan, franchise financing begins with you applying for funding. Once approved, you receive the funding and begin making regular recurring payments until the loan is repaid in full. Franchise financing can come from a variety of sources, and the exact mechanics of how borrowing and repayment work vary by loan type.

Franchise financing can come in many forms, and the type that will work best for your franchise will vary depending on your specific needs. The needs of a startup franchise, wherein the business owner is seeking funding to purchase the franchise and make it operational, are much different than the needs of an established franchise that may be seeking funding to use as working capital.

Some potential sources of franchise financing include long-term SBA loans or short-term loans and lines of credit. There are also providers that specifically focus their lending on franchise businesses. For business owners that wish to use their retirement savings or the equity in their home, to fund their franchise, there are financing opportunities in these areas as well.

Franchise Financing Providers

There are a number of different financing options that you can use for franchise financing. The type that you choose will depend on your personal financial needs. The most common types of financing include ROBS, SBA loans, crowdfunding, and using your home equity. Some other common options, including the franchisers themselves as well as friends and family.

Top Franchise Financing Providers

| Provider | Best For |

|---|---|

| SmartBiz | Business owners who want an SBA Loan with favorable rates and terms |

| Guidant | Business owners that have retirement savings that they are willing to use toward financing |

| Bluevine | Businesses that need a line of credit up to $250,000 |

| OnDeck | Business seeking a short-term loan up to $500,000 |

| Fundbox | Short-term loans up to $100,000 with no minimum credit score requirement |

| ApplePie Capital | Franchise business owners who need up to $2 million in financing |

| LendingTree | Business owners who want to utilize their home equity to fund their franchise |

SmartBiz for an SBA Loan

Franchisees who are operating a franchise location typically have their pick of financing options. We think the streamlined SBA loan from SmartBiz is the best option for those looking for up to $350,000 in working capital. With low SBA rates and 10-year repayment terms, these loans do not squeeze cash flow. Plus, SmartBiz has drastically reduced SBA loan funding times. Prequalifying online takes just a few minutes, and they get loans funded in as little as two weeks.

Guidant for a Rollover for Business Startup

A ROBS lets you fund all, or part, of your new franchise with retirement savings―401(k), IRA, 403(b), and so on―without paying early withdrawal penalties and taxes. If you have at least $50,000 in your eligible retirement account a ROBS can help you fund 100% of your franchise, be combined with seller financing, or be used as a down payment for an SBA loan. Learn more by speaking with our recommended ROBS provider, Guidant, which offers an initial free consultation.

BlueVine for a Small Business Line of Credit

BlueVine offers a business line of credit up to $250,000. If you have a credit score of at least 600, annual revenues of at least $100,000, and your business has been operational for at least six months, you can qualify for a line of credit with a six-month repayment term. Borrowers with a credit score of at least 650 and more than $500,000 in annual revenues are eligible for a 12-month repayment term. APRs range from 15% to 78%, and payments can be made either weekly or monthly.

OnDeck for a Short-term Small Business Loan

OnDeck offers short-term loans up to $500,000. Starting interest rates for the best-qualified borrowers start at 9.99% annual interest rate (AIR). Repayment terms range from three to 36 months. If you have a credit score of at least 600, one year of business operations, and annual revenues exceeding $100,000, then you can qualify. OnDeck has a simple online application that can be completed in 10 minutes or less, and you can get funded as soon as the next day.

Fundbox for Borrowers With Fair Credit

If your credit score is proving to be a challenge, Fundbox offers a small business line of credit of up to $100,000 with no minimum credit score requirement. The better your business has performed recently, the more funds you may receive. With a six-month minimum time in business requirement, Fundbox is a great startup business loan with no collateral option for borrowers with good recent history.

ApplePie Capital for Crowdfunding

If you run a franchise in its network, ApplePie Capital offers loans specifically geared towards franchises. ApplePie Core loans range from $100,000 to $2 million, with very competitive interest rates. For a broker’s fee, ApplePie Capital can help you obtain SBA, conventional, and equipment loans. You can apply online, and loans are typically funded within 30 days

LendingTree for a Home Equity Line of Credit or Home Equity Loan

If you’re shopping for a home equity line of credit (HELOC), you can reach out to one lender at a time hoping you find a good deal. You can also visit an online marketplace like LendingTree and review offers from multiple lenders at once. Save time, shop smart, and find a HELOC that fits.

Types of Franchise Financing

There are multiple ways in which you can fund your franchise. You can utilize your retirement savings through a rollover for business startup (ROBS), or you can seek a loan through the SBA, crowdfunding, or from your friends and family. If you have equity in your house, you can leverage that to get a home equity loan. Some franchisors even offer their own funding sources to help you get your franchise off the ground.

Seven Most Common Types of Franchise Financing

| Type of Financing | Best For |

|---|---|

| Franchisor Financing | Business owners that are able to obtain favorable financing through their franchisor |

| SBA Loan | Business owners with prime credit who need loan terms of up to 10 years |

| ROBS | Business owners that want to use their retirement savings finance a franchise |

| Online Working Capital Loan | Business owners in need of a quick source of working capital |

| Crowdfunding | Business owners buying into reputable franchises |

| HELOC/HEL | Business owners with real estate equity to use to finance their franchise |

| Friends and Family Loan | Business owners with friends or family willing to lend money for financing |

1. Franchisor Financing

Some franchisors offer their own financing, which can make the process easier for you as a potential franchise owner. Even if the franchisor that you are working with does not offer its own financing, it can be beneficial to have financing discussions with them because they have experience with where other franchisees have been able to obtain a franchise loan from. The franchisor also has a vested interest in you being able to purchase the franchise and will often provide some kind of help.

There are two main ways to get financing assistance from the franchisor:

- Negotiate the startup and operating costs: When buying a franchise, there are a number of things you need to buy before you can open your business. The cost for such items will be noted in the Franchise Disclosure Document. If negotiated, the franchisor may absorb the cost of some of these items for you like discounting your franchise fee.

- Work with the franchisor’s preferred lenders: Franchisors often partner with preferred lenders that they refer to for financing. They may also have relationships with leasing companies that can lease you essential equipment. When possible, consider working with these lenders, because they’re familiar with your franchise brand and model.

Working with the franchisor whenever possible can save you money and put you on solid ground as you continue your search for financing.

2. SBA Loans for Franchise Financing

SBA loans offer long repayment terms and low interest rates. An SBA 7(a) loan can be used for working capital, equipment, or commercial real estate. The SBA 504 loan is only for commercial real estate and fixed equipment. Franchises are often a great fit for SBA loans because of the SBA’s policy goals to help build small businesses to grow the economy.

An SBA loan has two major disadvantages for franchises. First, it takes a significant amount of time―30 to 90 days―to fund. Second, you can’t use the funds from an SBA loan to cover many startup costs, including franchise fees. Those will have to be paid as an out-of-pocket cost. However, SBA loan rates are typically the lowest you’ll find.

Costs of an SBA Loan for Franchise Financing

SBA loans have maximum interest rates ranging from approximately 7.75% to 10.25%. Additionally, you’ll be charged a loan origination fee ranging from 0.5% to 3.5% of the loan amount, and a loan packaging fee between $2,000 and $4,000. SBA also charges a loan guarantee fee of 2% to 3.5% of the loan amount.

The costs you can expect with an SBA loan for franchise financing are:

- Interest rates: 7.75% to 10.25%

- Origination fee: 0.5% to 3.5%

- Loan packaging fee: $2,000 to $4,000

- SBA guarantee fee: 2% to 3.5%

In general, the costs associated with an SBA loan are going to be lower than other forms of franchise financing. This is due to the fact that SBA loans are guaranteed by the federal government, thereby reducing the lender’s risk of loss in the event that you fail to repay the loan.

Terms of an SBA Loan for Franchise Financing

When using an SBA loan for franchise financing, you can anticipate loan amounts up to $5 million, although smaller amounts are easier to obtain. SBA loans can generally have repayment terms of up to 10 years. If you are financing the purchase of real estate with an SBA loan, the loan term can be extended up to 25 years.

The terms you can expect for franchise financing with an SBA loan are:

- Loan amount: Up to $5 million

- Repayment terms: Up to 10 years; 25 years for real estate

To learn more about how to apply for an SBA startup loan, and what documentation you may need, you can read our in-depth guide.

Qualifications for an SBA Loan for Franchise Financing

Qualifying for an SBA loan as a new business isn’t easy. You generally need to have a strong credit score―ideally above 680―some collateral, and a 10% to 20% down payment. However, a large percentage of SBA loans go to franchises because lenders can easily access loan performance data for franchises and predict the franchise’s ability to pay back the loan.

Typical qualification requirements for an SBA loan to fund your franchise are:

- Credit score: At least 680

- Down payment: 10% to 20% of the amount borrowed

The Franchise Registry

The Franchise Registry is a collaborative effort by a private organization called FRANdata and the SBA. The Franchise Registry lists the names of franchises for which the SBA has an expedited application process.

According to Meme Moy, a spokesperson for FRANdata, about 2,000 franchises are currently on the Registry. When a franchise is on the Registry, lenders can see its historical loan performance. About 55% of lenders only lend to franchises that are on the franchise registry, so this an important step in choosing a franchise. By choosing a franchise that is on the Registry, you can get better and faster access to SBA funding.

Where to Apply for an SBA Loan for Franchise Financing

SmartBiz is our recommended SBA loan provider. They offer working capital loans up to $350,000 and commercial real estate loans up to $5 million. They have taken the SBA loan process, which normally takes three to four months, and brought it down to about one month for the majority of borrowers. Plus, they can prequalify you online in minutes.

3. Rollover for Business Startups

A ROBS allows you to take retirement funds from a 401(k) or other eligible retirement account and invest them in your franchise without having to pay taxes or an early withdrawal penalty. Funds from a ROBS can be used as a down payment on larger financing like an SBA loan. They can also be used for franchise fees and other costs that traditional loans often can’t be used for.

A ROBS isn’t a loan, so there’s no debt or interest to pay back. This lets ROBS-financed franchises conserve more of their income and, as a result, they may be more successful in the long run. You do have to pay monthly administration fees when you do a ROBS but compared to a loan, the monthly fees are about 11x cheaper. This sets you up for a greater chance at long-term success than other financing methods.

“For many individuals, funding a business may involve taking on significant business or personal debt. With most loans, you would need to start making payments right away. This makes it difficult for your business to grow in its early stages when you’re trying to build revenue and generate profits. With ROBS funding, you avoid having principal or interest payments, which can impede your cash flow greatly, especially in the early years of business. Using retirement funds can also help your business reach profitability faster. Because you’re investing your own money in your own business, there’s no need to provide collateral, like your personal home.”

—Eric Schecterman, National Sales Director, Benetrends

When you set up a ROBS, you sponsor a retirement plan under your franchise, rollover funds from your personal retirement plan to the company retirement plan and use those funds to buy shares of stock in your business. The sale of stock creates the capital needed to start or buy a new franchise or recapitalize an existing franchise. Read our in-depth guide on ROBS to learn more about how it works.

So what’s the catch? You must have an eligible retirement account. Roth IRAs are not eligible, but most tax-deferred retirement plans are. Generally speaking, you should have at least $50,000 in the account to roll over. This means that ROBS are often not an option for young franchisees who haven’t had sufficient time to save money in a retirement account. In addition, there is a risk of doing a ROBS. For example, if the franchise fails, you could lose your retirement funds.

Costs of a ROBS for Franchise Financing

Since a ROBS is not a loan, you’re not paying interest and principal. The only cost you will incur is to a ROBS provider to set up and administer your plan to ensure compliance with all rules and regulations. Our recommended providers charge a setup fee of around $5,000 and an additional fee of $120 to $140 per month.

The costs that you can expect when using a ROBS for franchise financing are:

- Initial set up fee: $5,000

- Monthly maintenance fee: $120 to $140 per month

Qualifications for a ROBS for Franchise Financing

A ROBS is a lot easier to qualify for than traditional financing, but it can be a lot more complicated to understand. Essentially, you need to have a qualifying retirement account and meet these other standards:

- Retirement account must have at least $50,000

- Your retirement account is not from your current employer

- Be a legitimate employee of your new business

- Offer an employee retirement account in your new business

- Adhere to all IRS and U.S. Department of Labor requirements

Some of the qualifications and administration requirements can be cumbersome or difficult to manage. This is why we recommend using a third party to help you set up and administer your ROBS throughout the life of your business. You can learn more about who we recommend by reading our article on the best ROBS providers.

Where to Apply for a ROBS for Franchise Financing

Guidant is our recommended ROBS provider. Guidant has helped more than 10,000 businesses and facilitated more than $3 billion in small business financing since 2003. They are also the only ROBS firm we know of which guarantees access to outside independent counsel during the ROBS setup process, which can help you objectively evaluate if ROBS is a good decision for the franchise you are buying.

4. Fast Online Working Capital Loan for Franchise Financing

If you own an existing franchise and are looking for working capital financing, then you’ll likely have even more options than you had when you started your business. These loans can be used to fund any business activity, such as to make payroll or to make equipment purchases.

Costs of an Online Working Capital Loan for Franchise Financing

Online working capital loans may have interest rates ranging from 9% to 80% APR or greater, though borrowers typically receive rates averaging between 30% and 50% APR. Included in the APR calculation are loan origination fees that can range from 0% to 5% of the loan amount. Online working capital loans may include penalties for early repayment.

The typical costs you can anticipate with an online working capital loan are:

- APR: 9% to 80%; in general APRs fall between 30% and 50%

- Origination fee: 0% to 5% of loan amount

- Prepayment penalty: May have prepayment penalties

The costs associated with online working capital loans are often higher than you receive with a longer-term loan, with more stringent qualification requirements like an SBA loan. However, online working capital loans can provide you the financing you need much faster than an SBA loan would.

Qualifications of an Online Working Capital Loan for Franchise Financing

The exact qualifications for fast online working capital loans vary by lender, but in general, you will need to have a minimum credit score of at least 600 and one year of business operations. Additionally, you will need to have annual business revenues of $50,000 or greater.

The typical qualification requirements for an online working capital loan include:

- Credit score: At least 600

- Time in business: At least 1 year

- Annual revenues: At least $50,000

Where to Apply for an Online Working Capital Loan for Franchise Financing

Franchise businesses needing up to $500,000 within one to three days may want to consider a short-term loan through OnDeck. OnDeck requires a minimum credit score of 600, has repayment terms of up to three years, at rates starting as low as 9.99% AIR. OnDeck also offers a line of credit up to $100,000 with funding just as quickly.

5. Crowd Funding for Franchise Financing

Crowdfunding financing companies are platforms that raise money from both institutions and individuals, and they often lend it out to specific industries. Some focus on real estate while others will focus specifically on small businesses or franchises. They typically bridge the gap between traditional business loans like SBA loans and alternative loans with much higher costs.

Crowdfunding financing might be a good option if:

- You’re not a prime borrower but are close.

- You don’t want to pay the extra costs that many alternative loans carry.

- You can’t afford to wait for more traditional financing, like an SBA loan that can often take 90 days or more to fund.

One example of a crowdfunding financing company is ApplePie Capital, who lends exclusively to franchisees. They believe that crowdfunding financing is a good fit for franchises just starting out.

“ApplePie Capital can accelerate the growth of franchisees because we start by spending time with the franchisee up front to assess their situation, and then identify the best financing options to reach their short- and long-term goals. Sometimes, that will be SBA and, sometimes, it will be other options that the local bank doesn’t offer. Unlike the local bank, ApplePie knows the brand metrics. We can underwrite the loan ourselves for our core product or can educate our lender network on the brand so that the franchisee doesn’t have to.”

—Ronald Feldman, Chief Development Officer, ApplePie Capital

Costs of Using Crowdfunding to Finance Your Franchise

Franchise businesses utilizing crowdfunding to fund their franchises can expect to see interest rates ranging from 7.75% to 12%, depending on how well qualified they are. Additionally, you may be charged a loan origination fee of up to 4.5% of the loan amount borrowed on all new loans.

In general, the rates and fees that you can expect using crowdfunding to finance your franchise are:

- Interest rate: 7.75% to 12% fixed APR

- Origination fee: Up to 4.5%

- Prepayment penalty: None

- Loan amount: $100,000 to $2 million

- Loan term: 5 to 7 years

- Repayment schedule: Monthly

While interest rates on a crowdfunded loan are likely to be in line with financing options like SBA loans with shorter repayment terms, the monthly debt payment may be difficult to afford. Franchise businesses seeking longer repayment terms may want to consider SBA loans instead.

Qualifications for Crowdfunding Financing for Your Franchise

To qualify for a crowdfunding loan, you will typically need to have a credit score of 660 or higher, a down payment of at least 20% of the loan amount, a personal net worth greater than or equal to the amount you are borrowing, and that your franchise has been profitable for the past six months.

The general qualification requirements for a crowdfunded loan are:

- Credit score: 660 or higher (check your score for free)

- Down payment: 20%

- Time in business: Six months (with profitability)

- Personal net worth: Greater than or equal to the loan amount

Where to Apply for Crowdfunding Financing for Your Franchise

You can apply online for a franchise loan from ApplePie Capital. In addition to the basic information gathered through the online application, you will need to be prepared to provide the lender both your business and personal financial information, a copy of your franchise agreement, and proof that you have the required 20% down payment.

6. Home Equity Line of Credit or Home Equity Loan for Franchise Financing

If you own a home and have 20% to 30% equity in it, then you may be able to get a HELOC with a low interest rate. These funds are great to start a business and can be used for any of your startup fees, including your franchise fees. With a HELOC, you can get access to a lump sum immediately and draw against the total as you need it. Like a normal business line of credit, you only pay interest on what you’re using.

Anthony Truong, a franchisee of Two Maids & A Mop in Orlando, needed to get financing to start his business. He tried an SBA loan but realized it would take too long for him.

“My credit is very strong, and I owned my house outright. So, when I realized the SBA loan would take too long, I decided to go to my personal bank and apply for a HELOC. The whole process took less than two weeks, the interest rates were great, and I never looked back. I was even allowed to use the HELOC for my franchise fee, which other financing wouldn’t allow.”

When you get a HELOC your personal home will be used as collateral. This means that if you fail to make payments in the future, then you could lose your home. That is the risk that comes with the benefits of receiving access to low-interest rate funds as you need them. With a HELOC, you can borrow up to 80-90% of your home equity with an APR as low as 3%.

Costs and Terms of a HELOC/HEL as a Franchise Loan

The basic costs associated with a home equity loan or HELOC for franchise funding are the initial closing costs and the annual interest rate on the loan. Closing costs will typically fall in the range of 2% to 5% of the loan amount and will include costs such as the application fee, appraisal fee, and any real estate recording fees. Interest rates on HELOC/HELs are generally in the range of 3% to 6%.

The typical costs associated with a HELOC or HEL are:

- Closing costs: 2% to 5% in closing costs

- Annual interest rate: 3% to 6%

- Credit score: 620+ for a HEL, 680+ for a HELOC

- Equity: At least 20% equity in your home; the rule of thumb is between 30% and 40% minimum

- Maximum loan-to-value (LTV): 80%, based on the appraised value of your home

Where to Apply for a HELOC

A HELOC is typically found at your local bank. To learn more about a HELOC and why it may be the right option for you, read our article on home equity loans and HELOCs.

For those considering tapping into their property’s equity, look at LendingTree. Their online marketplace has a large number of lenders allowing you to compare rates, offers, and find a good fit. Seeing your options takes just a few minutes.

7. Friends & Family Loan for Franchise Financing

If you have a significant amount of support from people that you know, then borrowing money from them might be a good option to fund part or all of your franchise. This type of financing is very flexible and negotiable because you can work with people you know to come to an agreement on how to repay them, and what interest you’ll pay.

While it is flexible, the problem with borrowing from friends and family is that it can be hard to ask people who you have a personal relationship with for money. It also feels very unprofessional to go to your friends and family members with your hand out.

Costs of Friends & Family Loan for Franchise Financing

In Jun 2019, the required minimum interest rates were:

- Short-term loans (less than three years): 1.80%

- Long-term loans (up to nine years): 2.09%

These rates come from the IRS Index of Applicable Federal Rates (AFR), which updates on a monthly basis. This AFR index provides the minimum interest rates the IRS expects on all loans. Even if your friends or family do not wish to receive a return on their money, it is important for you to pay interest on the amount you have borrowed, or the IRS may see the money as a gift and tax you for it.

Where to Get a Friends & Family Loan for Franchise Financing

That is why you should use an administrative service to manage your loan and give you a professional platform to raise the money and make payments to. This can make it easier for people you know to lend money to your business, and you won’t have to worry about any of the paperwork or tax implications. It could also improve your chances of getting funded.

Tips on Applying for Franchise Financing

It’s often easier to get started with a franchise compared to an independent business because a franchise comes with a proven concept, brand recognition, and customer base. The success rates of individual franchises vary widely and still rely heavily on the business savviness of the owner.

You’ll stand a better shot at being one of the approved franchises if you keep the following in mind:

- Choose a good franchise: You should have a specific franchise in mind before approaching a lender. Consider things like location, historical performance, startup and operating costs, and brand value when choosing a franchise.

- Check out the franchise disclosure document (FDD): The FDD is the most reliable way to figure out the estimated startup and operating costs for your franchise. We recommend having a lawyer and accountant review the document before you agree to purchase a franchise.

- Request a regional franchise disclosure document: Feldman suggests that in addition to the standard FDD, “New franchisees request a supplemental Item 19, which is required by law to be provided if available.” This can help you understand how the franchise performs in your own geographic location.

- Create a solid business plan: Many people wrongly assume that just because they’re starting a franchise, they don’t need a business plan. Even if a franchise has numerous locations throughout the country, each unit is an independent business with unique strengths and weaknesses.

- Improve your personal credit score: Your personal financial history and credit score will be critical when applying for financing. To increase your score, pay bills on time, reduce the amount of credit you use, and be selective about how many loans you apply for.

- Maximize your personal investment: Bring as many personal resources as you can to the table. This decreases your reliance on external financing and shows that you have a vested interest in the franchise. For an SBA loan or bank loan, you will generally need a 10% to 20% down payment at a minimum.

- Gather collateral: Having collateral will go a long way towards getting approved for a franchise loan, particularly an SBA loan or bank loan. If you’re buying real estate, then it can serve as collateral. If not, personal real estate, business equipment, or other assets will often work to secure your loan.

- Don’t do it alone: It’s important to find help in your financing process. According to Feldman, “Potential franchisees should always attempt to connect with other existing franchisees and talk to them. The key benefit of becoming a franchisee is being in business for yourself but not by yourself.”

Getting financing can be a long, complicated process, regardless of your qualifications. Make sure you limit the time and energy it takes to get through that process by having all the necessary information and documentation collected ahead of time.

Costs of Opening & Running a Franchise

To get a good estimate of costs, the first thing we recommend doing is asking the franchisor for their FDD early on in the process. It’s a good idea to have an accountant and lawyer review the FDD with you before you sign any paperwork or hand over any money. A franchisor is legally required to give you the FDD at least 14 days before you buy a franchise.

Below are some of the average costs associated with starting a franchise that should be covered in the FDD:

- Initial franchise fee: One-time fee that often ranges from about $20,000 to $30,000 but can be higher for well-known national brands.

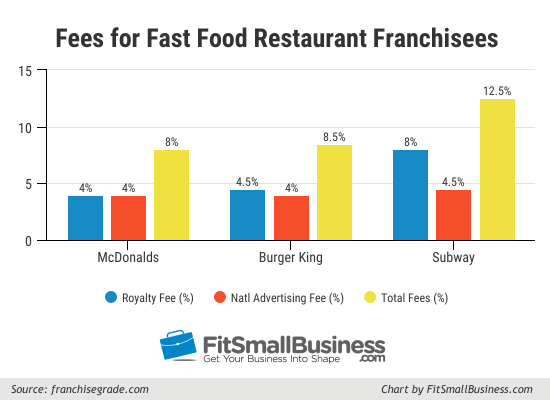

- Ongoing royalties: These generally range from 4 to 8% of gross revenues and may be paid weekly or monthly.

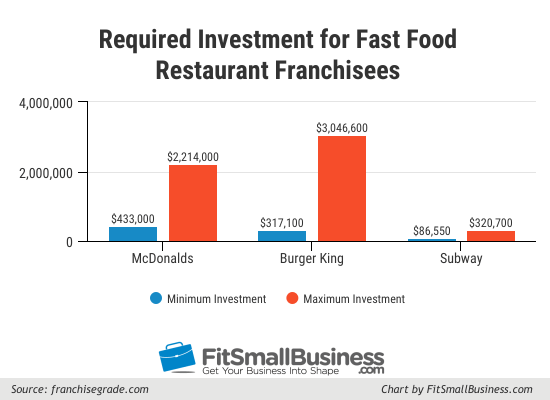

- Net worth/liquidity: Large franchisors won’t even consider you if you don’t bring a certain amount of net worth and liquid assets to the table. For example, Subway requires $80,000 in net worth and $30,000 in liquid assets, whereas Burger King requires a $1.5 million net worth and $500,000 in liquid assets.

- Hiring costs: According to the Bureau of Labor Statistics, the average salary of a retail worker was $10.60 per hour in 2015, but that doesn’t include the time it takes to hire and train employees and the costs of employee benefits, health insurance, and business insurance.

- Equipment, marketing, and other miscellaneous costs: You may be assessed a weekly or monthly marketing fee apart from royalties to pay the franchisor for marketing material. Equipment purchase is generally a significant startup cost for a franchise.

Before you can obtain a franchise loan, you’ll have to decide how much money you’ll need to start and operate your franchise. Remember, on top of the costs associated with purchasing and opening a franchise, you will likely have to pay for a lawyer and accountant to review your franchise and loan paperwork.

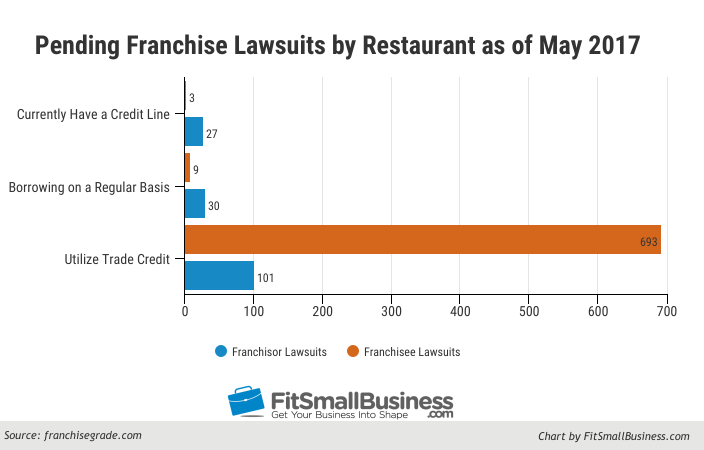

FranchiseGrade.com has a free tool that lets you compare the startup costs of different franchises. It has data on more than 2,500 franchises. Here’s a sample collection of data from its system that we’ve put into graph form:

“Every person looking to invest into a franchise needs to do a comparison shop. You shop for a car, TV, house, and phone. Why wouldn’t you shop for your business? It’s a larger investment, and it is paramount that you need to do this. A lot of franchises don’t make it past two or three years, and a lot of that has to do with their comparison process or lack of it when they’re deciding which franchise to start.”

—Jeff Lefler, Founder & CEO, Franchise Grade

It’s important to dive into the numbers of your franchise before knowing if it’s a good fit. How good the food is, or how much you like the product should be secondary.

Pros & Cons of Franchise Financing

There are both pros and cons to franchise financing. Some of the advantages include that franchises can be easier to finance than a typical new business startup and that lenders often see them as a less risky investment. The disadvantages include that franchise history can sometimes lead to false expectations of success, and they require a hefty initial investment.

Pros of Franchise Financing

Some of the benefits of franchise financing are:

- It can be easier to finance than a new business: One of the benefits of buying into a franchise is that the business comes with an established performance history. This makes financing a new franchise easier than financing a brand new business.

- Franchises are often seen as less risky: Lenders can evaluate the success that a franchise has seen easily and measure standard default rates for that business model. With this information so readily available, they can approve funding with a higher level of confidence, which makes the process easier for you as the borrower.

Cons of Franchise Financing

Some of the disadvantages of franchise financing are:

- False expectations of success: Opening a franchise can give you a false expectation of success. Despite the fact that a franchise offers you an established market and brand presence, it is still a business that requires skill to operate successfully.

- Initial payout and startup costs: The upfront costs of opening a franchise can be a deterrent. Unlike other startups where you can slowly scale your business over time, opening a franchise requires your business to be completely operational from the onset. This requires full staffing, merchandising, and inventory before you can even open.

Franchise Financing Frequently Asked Questions (FAQs)

A lot of information has been covered in this article about franchise financing, what lending options are available for inventory financing, and the pros and cons of using inventory financing, and here are a few of the frequently asked questions regarding franchise financing. If you have any questions about any of the information presented here, you can post them in the Fit Small Business forum.

Do banks loan money for franchises?

You can obtain a loan from a bank to purchase a franchise. SBA loans, which are issued by traditional lenders and guaranteed by the SBA, are frequently used to finance the purchase of a franchise. These loans have interest rates ranging from 7% to 11% and loan terms of up to 10 years.

Can you get an SBA loan for a franchise?

SBA loans are frequently used to fund franchises. To find out if the franchise that you are interested in qualifies for an expedited SBA franchise loan, you can review the Franchise Registry compiled by the SBA. SBA loans offer loan terms of up to 10 years, and interest rates from roughly 7% to 11%.

How do you raise money to open a franchise?

There are multiple sources of funding that can be used to finance a franchise. You can use your retirement funds through a ROBS or draw on your home equity with a HELOC/HEL. For a more traditional source, an SBA loan or a loan from a crowdfunding source can be used to fund your franchise.

Bottom Line

A franchise gives you the opportunity to have your own business with the safety net of a proven business model. However, the costs of starting and running a franchise can be substantial. The two best financing options to start your franchise are ROBS and SBA loans. If you’re not sure where to begin, your franchisor can likely offer suggestions, because they should have experience with financing your specific franchise.

A ROBS is a best-kept secret in franchise financing. You can combine it with seller financing, use it as an SBA loan down payment, or fund 100% of your franchise with it. A ROBS saves you from making a large monthly payment while you’re trying to get your business off the ground. Visit our recommended ROBS provider, Guidant, to get started.

Read More

0 تعليقات