Learning startup terms can prepare entrepreneurs for successfully opening their first business. For instance, knowing what a limited liability corporation (LLC) is and registering a business as one helps protect an owner’s personal assets from business debt. The startup terminology below is useful in conversation with employees, vendors, and lenders and when making business decisions.

Here is a list of startup terminology you should know.

1. Angel Investor

An angel investor is someone who invests money into a startup in exchange for equity. Raising money from an angel investor to start your business is less risky than getting a loan from a bank. If your business were to fail, you would not need to repay an investor the money they contributed to the business. However, you would be liable to repay a bank loan.

The downside to having an angel investor is that you have to give up equity in your company. As your business makes money, you will need to pay your investors a certain percentage of earnings. Typically, investors are looking to make at least a 25% return on their investment.

Angel investors are hard to come by. The best way to find one is by first having a well thought out business plan with financial projections. Then, you need to start networking in your community. Some angel investors are wealthy individuals with extra cash. Others are groups of individuals who pool their money together and invest as a group. You can also look to crowdfunding websites that raise capital from angel investors online.

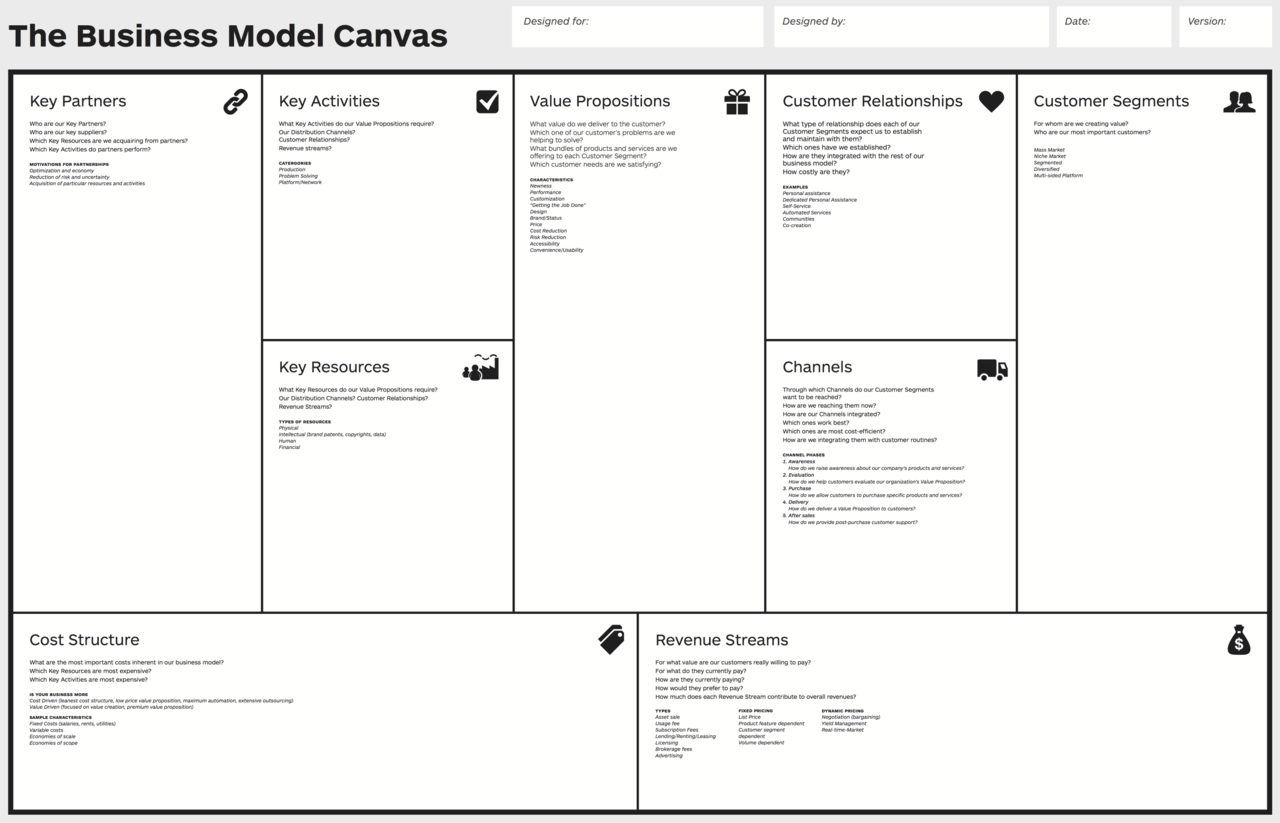

2. Business Model Canvas

The business model canvas (BMC) is a newer and more visual business plan. A business plan helps you put your business idea on paper and is where you make a case for why your business will be successful. Every good business plan also includes financial projections, which show how much the business will make and spend every month for the first three years.

Sections in the BMC include:

- Customer segments: This is where you go into detail about your ideal customers. Answer questions like what do they believe? Where do they go online? What do they feel? What are their habits?

- Value propositions: This is where you answer the overarching question of why a customer will do business with you. Why do customers buy your product or use your service instead of the alternatives?

- Channels: In this section, you explain how your idea will reach your customers. Channels to reach your customers could be physical, like a storefront or food truck, or virtual, like an ecommerce website.

- Customer relationships: In this section, you discuss how you interact with your customers and where in their purchasing journey your business fits?

Banks are starting to accept the BMC as an alternative to the traditional business plan. Some information in the BMC is similar to the traditional business plan but, overall, they contain different types of information. If you’re looking for debt funding, make sure the bank will accept a BMC in place of the traditional business plan.

If you choose to create a BMC, you could write the basic information about your business in less than 30 minutes. However, if you’re creating a BMC for a bank loan, the amount of content is comparable to a traditional business plan and may take you weeks to gather the applicable information.

The BMC is a visual business plan whereas a traditional business plan is similar to a business report

3. Financial Projections

Financial projections are the most challenging part of any business plan. They are also the most important. Financial projections are estimates of how much money the business is projected to earn and spend over the first three years in operation. Additionally, you will use your financial projections after opening the business to determine if you’re meeting or missing your monthly goals.

Many potential business owners struggle with financial projections because they have to predict their income and expenses. If you’re going to own a store with a physical location and employees, it may require a lot of research to determine what your total expenses will be. You also need financial projections if you are seeking funding. A bank or angel investor will review your business plan so they can simply learn when they will receive a return on their investment.

Standard financial projections include the startup costs businesses incur before they open. Then, including the costs to start the business, you make month-to-month predictions of how much revenue and expenses the business will make for the first two years. The revenue is broken down by general products or services. The expenses are broken down more specifically with costs like rent, insurance, salaries, utilities, product, and marketing.

Service Corp of Retired Executives (SCORE) provides an excellent financial projections template use. If you find yourself unable to understand how the template functions, you may need to hire an expert, like an accountant, to assist.

4. Limited Liability Corporation

An LLC is a type of legal entity you can register your business as. By registering your business, a legal entity protects your personal assets if a lawsuit were to occur against the business. There are several types of legal business entities. However, 80% of small businesses register as an LLC. The LLC is the simplest business entity to register and typically requires the least amount of work to reregister each year.

When starting your business, registering as a legal entity is one of the first things you should do. IncFile provides a fast and secure way to register your business online. Register your business today for as low as $49 plus any state fees.

5. Fictitious Name

A fictitious name is the name of your public business, which may be different than your business’s officially registered name. For example, a home services company could be officially registered as Smith Home Services and the plumbing company could operate under the registered business name as Smith Plumbing. The specific branding for plumbing is clearer for potential customers than a general home services company.

Fictitious names are common when a business goes through name rebranding. When this happens, a business doesn’t want to change the name of its officially registered name because the fictitious name is typically much cheaper than the cost of reregistering a business. Let’s say you are planning on opening several different types of businesses during the next 10 years. You may want to register each future business under one company to save money. Customers would know them under their fictitious names, although they’re officially registered under a different name.

You may find that the fictitious name is also called a doing business as (DBA). Many times at the bottom of a website, a company will have its DBA listed in addition to its registered business. Another purpose of a DBA or fictitious name is for when a customer wants to file a complaint about a business, they can find that business’ information online accurately.

6. Business License

A business license is a legal document that certifies you’re allowed to operate a business in a city or state. Not all businesses need a license to operate. Typically, specific types of businesses that may pose a risk to customers need a license. For example, businesses that offer cosmetology, provide day care, or sell alcohol and tobacco need a state license.

Additionally, your city may require specific business licenses for certain industries. For example, an observable home-based business like a pest control company may need a city license to operate from a house.

7. Elevator Pitch

The elevator pitch is the 30-second description of your business. If you took a brief elevator trip with a potential customer, how would you describe your business? Elevator pitches start with a catchy sentence describing the core of what your business does, and every additional sentence describes more about your business.

It is worth nailing down a clear elevator pitch because you will be describing your business to hundreds of people in your community. It’s important to be able to communicate clearly what it is you do and why it is unique.

“An elevator pitch is an introduction to an investor that wraps up in 30 seconds. You have to answer three questions: What are you doing? Why are you doing this? How do you do this?”

―Andrey Korhov, CEO, Sarafan Technology

8. Crowdfunding

Crowdfunding is raising money for your business before opening it. Depending on your needs, there are several types of crowdfunding websites. Rewards-based crowdfunding is selling rewards―products or services―to your customers in advance of opening, like the website Kickstarter. There are also debt crowdfunding sites you can use to raise money from several individuals like Lending Club. Another type of crowdfunding strategy is equity crowdfunding. This is when you pledge a percent of your company to several investors in exchange for funds, like the equity crowdfunding website Fundable.

Many startups try crowdfunding because raising capital to start your business is difficult. Banks don’t lend to startups because startups usually haven’t accumulated any business assets. If banks do lend to startups, they require that you deposit the loan funds in a separate account like a certificate of deposit, so they can recover their loan if the business fails.

9. Key Performance Indicators

A key performance indicator (KPI) is used to measure the progress of a business goal. Typically, a KPI is a number, because it must be measured. As a business owner, a KPI you may use is to track annual business revenue. However, when tracking progress for individual employees, you may need to use a different measurement. For example, KPIs for employees in the marketing department could be website visits, leads received from social media, or new Google reviews.

“One of the most important terms you should be aware of as a small business owner is KPIs, which are key performance indicators. KPIs are used to measure how successful your business is based on the type of actions you are taking to achieve incremental goals throughout the year.

“KPIs can either be qualitatively measured or quantitatively measured, and the best part is that you set these KPIs. An example of a quantitative KPI would be ‘increase organic website traffic by 15% YoY [year-over-year] by adding creating mobile-friendly pages.’ An example of a qualitative KPI would be ‘improve customer experience by creating two mobile-friendly pages every month.’”

―Audrey Strasenburgh, Search Engine Optimization (SEO) Strategist, Logo Maker

10. Brick and mortar

Brick and mortar is a business term used to describe a store that offers products or services to customers. This term is used interchangeably with “physical location.” When telling people you’re opening a business, you may need to iterate that it is brick and mortar, because the person may assume it is an online business. You may find that professionals working with small businesses like accountants, attorneys, and insurance agents are more likely to use the term “brick and mortar” to describe a business than the general public.

11. Coworking

Coworking is sharing an office with other business owners and remote workers. Many business owners choose to open their business in a coworking location because it is more affordable. Additionally, it provides great networking opportunities. Some coworking locations have 50 or more businesses sharing an office building. There are often lunchtime and after-hour networking events held by the coworking company.

At a coworking location, you can accept customers and have meetings, but it would not be considered a brick-and-mortar business. There are several types of coworking options. For example, a business owner could have a dedicated desk from which to work, or they could pay more for a dedicated office for their team.

Coworking includes shared desks, private desks, private offices, and shared conference rooms

12. Point-of-Sale System

A point-of-sale (POS) system records sales, processes payments, and provides tools to help manage brick-and-mortar business operations. Many POS systems include both software and hardware, which can be incorporated into a tablet for mobility. Management tools like inventory management, sales reports, and employee management are often included within the software. Costs for a POS system range anywhere from free, with a system like Square, to $99 per month for the software plus a $1,000 one-time fee for hardware.

The most affordable POS option for a startup is Square. Their software is free. Square earns money by requiring you to use its payment processor, which starts at 2.75% per swipe. Square’s most basic processing hardware costs $10, which allows you to receive payments from your phone. As your business grows, you can purchase additional hardware like the Square Terminal, which accepts payments and print receipts for $399.

The Square Register is Square’s most expensive POS system at $999

13. Freemium

Freemium is a new term that all budget-conscious startup owners need to know. The term generally applies to software that provides a free, but limited, version. As you want to use more features, there’s an additional cost. Freemium is a great way to test the basics of a software. You can purchase the full version after you know you like using it. For example, Wave is a free accounting software. There’s no cost to use their accounting, invoicing, and receipt programs. However, using their payment processing and payroll software is an additional cost.

“Freemium is a business model that splits users of a product or service into two different categories. One category is for users that do not pay for the product or service and thus have limited access. They use the product or service for free. The other category is for users that pay for the account and, therefore, have full access or more benefits than the other category.”

―Dr. Martin Heibel, Cofounder, Ciara

14. Competitive Advantage

Your business’s competitive advantage is what it does better than the competition. What do you do so well that it’s difficult for your competition to replicate? If you’re going after funding from an angel investor, there’s a good chance they will ask you what your competitive advantage is. Examples of formal competitive advantages include patents and government contracts. Informal competitive advantages might be your network within an industry, a superior product, or use of new technology.

15. SEO vs SEM

New business owners often confuse SEO with search engine marketing (SEM). Unfortunately, marketers tend to use the words interchangeably, which adds additional confusion. If you are paying a marketer for either of these services, you need to know the differences and the services for which you’re paying.

SEO is the practice of getting your website or Google My Business (GMB) to rank in a search engine, like Google’s organic (free) search results. SEM is paid advertising, typically getting a website at the top of the search results. If you stop paying for SEM, your website will not show in the search results, whereas if you stop paying for SEO, typically, your website will still show in the search results for some time before it starts to fall in the rankings.

What you need to watch out for is when marketers say they’re doing SEO, when it is SEM. It may take longer for your business to be found in Google with SEO, but the positive results could last for years. SEM is a quicker strategy but, as soon as you stop paying, your website will disappear from the search results. If you’re interested in ranking higher in Google search results, you need an online marketing strategy that is part SEM and SEO for short-term and long-term results.

“A very important term every small business owner should know is SEO. SEO is what you do for your product or service to show up in search engine results. If you have good SEO, you should pop up on the first page when a consumer is searching for something related to your business or service. However, it isn’t as simple as that, SEO is very complicated and every small business owner should get around to researching and implementing it effectively.”

―Patrick Dhital, Co-founder, Honey Skin

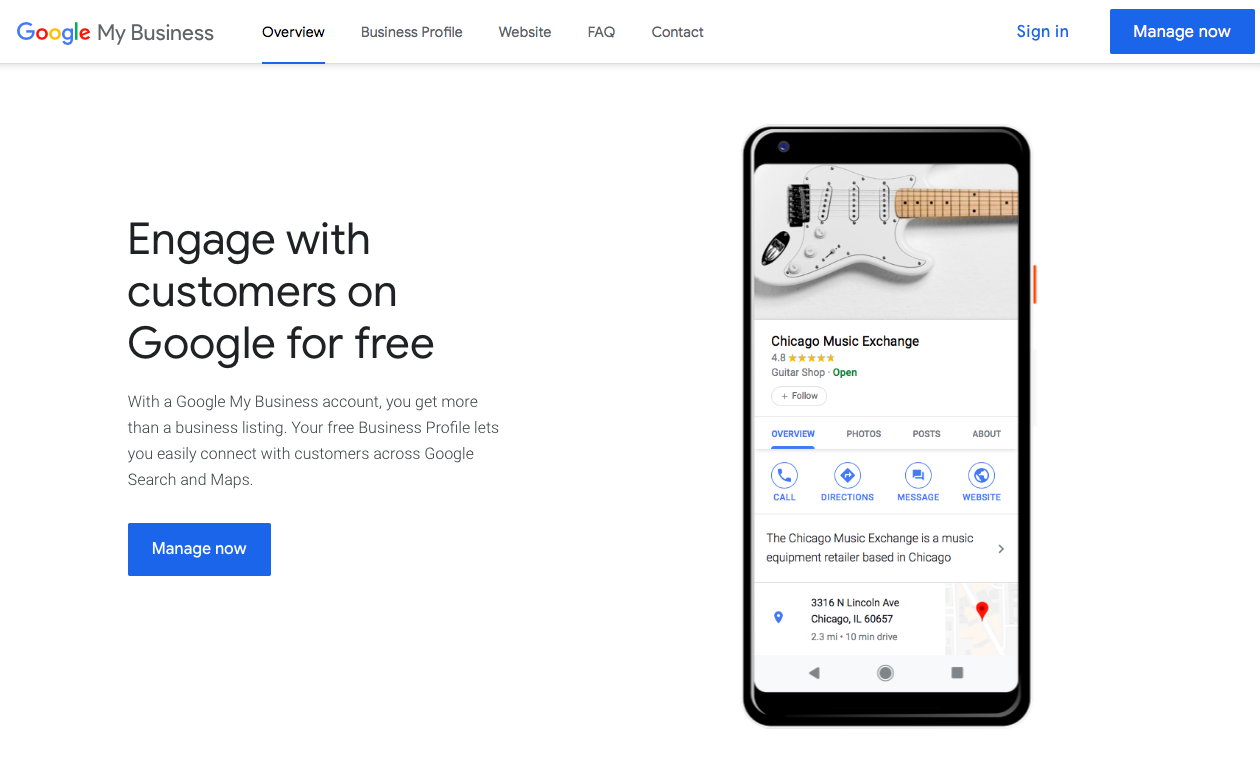

16. Google My Business

Every business that has local customers receives a free business listing on Google called Google My Business. You don’t need a brick-and-mortar business to have a GMB. You can service local customers from home. The listing shows and provides information about your business when someone searches Google for your business name. Similar to a directory, the GMB listings show what your business does.

In your listing, you should fill out your basic business information like address, phone number, and hours of operation. You should also add photos and videos about your business. Claim your business’s shortcode, which is similar to your website domain name (www.yourcompany.com) that you type into an internet browser Once you claim your short name, start encouraging customers to leave you a Google review.

Google My Business is a free opportunity to get your business found on Google

17. Guerilla Marketing

Guerilla marketing is an advertising strategy that involves using unconventional methods to reach potential customers. As a business owner, you need to be thinking outside of the box constantly to reach your potential customers in ways your competition is not.

For example, instead of placing a typical promotion sign outside of your brick-and-mortar location, display a humorous sign that makes people stop and consider your business. You can also use business promotional material that is different than the standard business card. Lush provides lawn care services in southeast Michigan. It created a business card that includes lawn seeds with a promotional message. This is a guerilla marketing strategy that potential customers will remember.

Lush lawn maintenance company uses guerrilla marketing strategies to make their business unique and memorable

18. Cash Flow

Cash flow is the process of cash coming into or going out of the business. It’s important as a business owner to know where your money goes within your business. Unfortunately, many business owners simply sell products, pay the bills, and hope there is enough money left in the bank account to keep the lights on. Cash flow analysis helps better understand where the money is going in the business to determine if there is too much spending on a particular expense like marketing or inventory.

“It’s important for small business owners to understand cash flow, or the cash coming into and leaving the business. Positive cash flow means that the business is generating more cash than it’s spending and demonstrates that it’s in a strong position to pay debts or reinvest in the business. For businesses using accrual accounting, cash flow can be difficult to track because financial reports show revenue and expenses as they’re incurred—not when cash changes hands. This is an important distinction for business owners to understand in order to manage their cash effectively.”

―Kurt Rathmann, Founder & CEO, ScaleFactor

19. Small Business Development Center

The Small Business Development Center (SBDC) is a government-funded program that provides no-cost consulting and low-cost training to business owners. There are more than 1,000 SBDCs around the United States with more than 5,000 consultants. As a new business owner, the SBDC can be an excellent resource for getting advice from former business owners. Additionally, the consultants tend to be well connected in the business community and may be able to recommend professional resources like accountants, attorneys, bankers, and insurance agents.

20. Buy-Sell Agreement

A buy-sell agreement is a legal document that determines what happens with the ownership shares of the business if a partner leaves or is unable to work. It’s a good idea to create this agreement before you open the business rather than when a problem arises because of the legal fees that incur when deciding business ownership. Having an attorney draft an agreement between you and your partner is more affordable than going through litigation to determine what happens to the partner’s portion of the company.

“Anyone starting a business needs to know the term ‘buy-sell agreement.’ I have to admit, when I founded my company with my two cofounders four years ago, crafting our buy-sell agreement felt like creating divorce papers on your wedding date in case you need them later.

“Luckily, we listened to our counsel and crafted the buy-sell agreement because three years later, one of my cofounders wanted out of the business. He was getting married and having a child. As it turned out, his new wife didn’t want him pursuing his entrepreneurial dreams any longer.

“Life happens and you never know what the future holds. Fortunately, in our case, we had a stack of documents to go back to and unequivocally discern what he was owed for his portion of the business. As you can imagine, it was a lot less than what he thought and that agreement quite possibly saved our company.”

―Zach Hendrix, Founder, GreenPal

Bottom Line

Understanding basic startup terminology is essential to opening your first business. You don’t have to be an expert to understand cash flow, Google My Business, or an elevator pitch. Seasoned business owners are still unaware of several of these business terms. Use these startup terms to get ahead of the competition and set up your business for success.

Read More

0 تعليقات