It was only a decade ago that the 2008 recession wrecked businesses, turned the housing market upside-down, and destroyed personal assets. Unemployment hovered near 10% while entire industries quaked. Fed Chair Ben Bernanke called it the worst financial crisis in our history.

Despite the economic growth the U.S. experienced in recent years, there’s concern about another looming recession. In fact, a 2019 survey of more than 500 CFOs from across the world conducted by Duke University’s Fuqua School of Business found that almost half predicted a 2020 recession. There was some fear about this in 2017, when we conducted a study on the best states to survive a recession, but with recession concern growing, we took another look at the data.

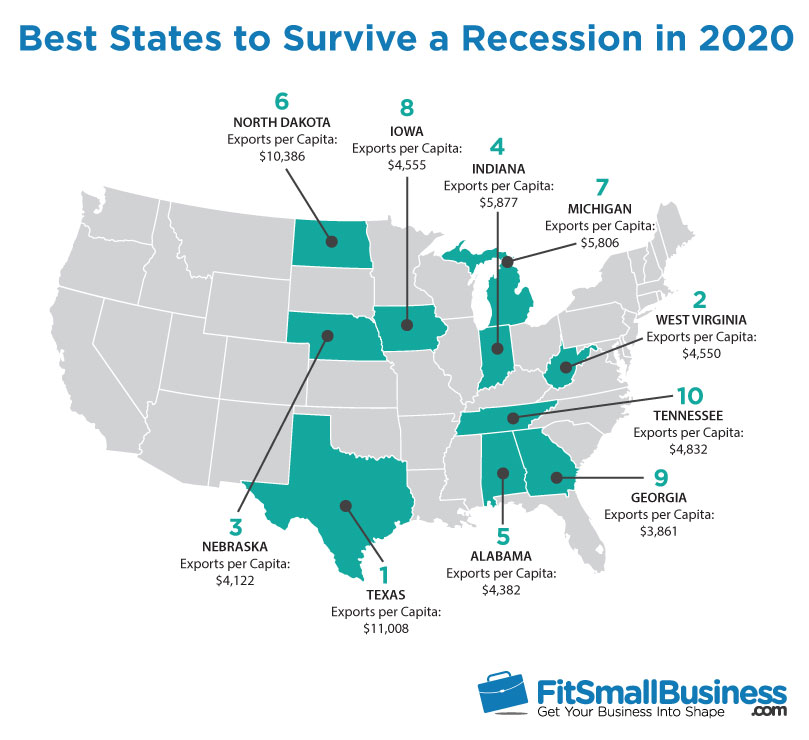

So how—and where—do we survive a recession if it hits in 2020? As Fit Small Business dug into national and state-based economic data, we uncovered something interesting: The states best equipped to survive a recession in 2020 were markedly different from the ones in our 2017 study. All of them boast business diversity and minimal per-capita debt, but the changes over the last two years were remarkable.

Texas, for example, jumped from No. 15 in our 2017 study to No. 1 in this study, while states like Tennessee were newly inaugurated. Indiana jumped up from No. 10 to No. 4, while other states—like Nebraska and Iowa—remained fairly close to their 2017 rankings.

To determine which states are the most recession-proof in this revised study, we considered a wealth of data, including product exports, housing costs, individual debt averages, average deposits per capita, and trade. We then weighed these (see methodology below) and compared our resulting list of the top states for recession survival with the study we completed in 2017.

- Stabilization (aka surplus or emergency) funds available (15%)

- Economic strength and diversity (15%)

- Debt-to-income ratio (10%)

- Unemployment rate (10%)

- Median home value (10%)

- Exports per capita (10%)

- Export diversity (10%)

- Deposits per capita (7.5%)

- Average credit card debt (5%)

- State income tax rate (5%)

- 2008 recession performance (2.5%)

Read on to find which are the top 10 states to survive a recession in 2020. We also list our definitive ranking of all 50 states below.

1. Texas

Best state to survive a recession 2020: Texas

They say that everything is bigger in Texas, and that holds true in terms of its financial strength and stability. It has the second-lowest debt-to-income ratio in the nation at 1.16, the third-highest total exports per capita, and a diverse range of industries that make up its GDP portfolio. What’s more, its top export countries—Mexico, Canada, and China—are relatively big players in the international trade scene.

Texas also has a low unemployment rate of just 3.4% and the nation’s lowest state income tax rate of 0%. It also has an average home value of $198,100—one of the lowest in the country, which means less equity will be lost if funders go under. To put a cherry on it: Texas has a history of faring well through recessions, with a minimal -.6% GDP drop in the recession of 2008—notably less than the -2% average.

2. West Virginia

Best state to survive a recession 2020: West Virginia

West Virginia climbed the ranks to the second best state to survive a recession in 2020, up from No. 8 in 2017. It boasts significant exports to Canada, India, and the Netherlands—illustrating not only economic diversity, but lack of dependence on one geographic region. It also has the fourth-highest amount of stabilization funds available, at 16.8% of the total state budget, and its debt-to-income ratio decreased from 1.209 to 1.165 from 2017 to 2019.

The Mountain State remains the most affordable state in the nation with a median home value of $98,300—more than $100,000 lower than the national average median home value in 2019. What also sets it apart is that, unlike most states that suffered a loss in GDP during the 2008 recession, West Virginia’s GDP actually grew by a modest 0.1%.

3. Nebraska

Best state to survive a recession 2020: Nebraska

Nebraska slipped to the third-best state to survive a recession in 2020 after landing at No. 2 in 2017. There are several things going for it, however: it has a low unemployment rate of 3.1%, with a diverse range of export countries (Mexico, Canada, and Japan), and its top export country makes up 22.31% of its total exports, near the national average of around 20%. It also has a low debt-to-income ratio of 1.165 and it has the 10th-highest yearly deposits per capita at $35,000.

Also, those living in the Cornhusker State enjoy a lower-than-average median home value of $168,600, making future housing purchases more accessible to those who suffer from income or asset loss during a recession. To further demonstrate Nebraska’s resilience to recession, the state boasted a 1.3% gain in GDP in the year following the last recession (2008).

4. Indiana

Best state to survive a recession 2020: Indiana

Indiana takes the No. 4 position in our 2019 study, up from the 10th position in 2017. Its debt-to-income ratio dropped from 1.34 in 2017 to 1.165 in 2019, while its GDP grew from $273 billion in 2008 to $367 billion in 2019. Indiana also has the eighth-highest exports per capita at $4,122.

The real estate market has also evolved in Indiana since 2017 with a drop in median home value from $186,000 to $147,000 in 2019. While this indicates a drop in demand, it also suggests more affordable housing for residents—key for those who want to get back on their feet after a hard-hitting recession. Last, but certainly not least, Indiana boasts a low income tax rate of 3.23%—the nation’s fourth lowest.

5. Alabama

Best state to survive a recession 2020: Alabama

Alabama lands as the fifth-best state to survive a recession, up 15 positions from 2017 when it was ranked at No. 20. Its low debt-to-income ratio of 1.37 is the fourth best in the nation along with solid economic diversity; the top industry’s share of GDP is just 16.5%—about 5% lower than the national average. Over the last decade, the state’s GDP also rose from $173 billion in 2008 to $221 billion in 2018.

Additionally, since our 2017 study, Alabama’s deposits per capita increased by $2,000 per year and its unemployment rate dropped from 4.6% to 3.1%—half a percentage point below the national average. It also has the fifth-lowest median home value in the nation at $133,800—55% of the national average—leaving less real estate equity to be wiped by a recession.

6. North Dakota

Best state to survive a recession 2020: North Dakota

Previously the No. 1 state to survive a recession in 2017, North Dakota is now the sixth best state to survive a recession in 2020. It has the best average debt-to-income ratio of any state at 0.74 and the second-best unemployment rate in the country of 2.4%, just behind Vermont at 2.1%. It has the fourth-highest exports per capita at $10,386, with total exports at $7,894,077,498. North Dakota also fared well during the 2008 recession with a 2008–2009 GDP gain of 2.10%.

What harmed its score was a low percentage of stabilization (“rainy day”) funds at just 5.2% of the total state budget. It also has almost 88% of its total exports going to one country (Canada)—the second-highest export dependence in the nation.

7. Michigan

Best state to survive a recession 2020: Michigan

Despite its -8.40% 2008–2009 GDP loss following the last recession, Michigan bounced back from No. 31 in our 2017 study. Its debt-to-income ratio dropped from 1.35 to 1.165—well below the national average. It also has the ninth-highest exports per capita of $5,806, with total exports clocking in at $58,034,773,175.

What’s more, the state’s economy is buoyed by the fifth-lowest average credit card debt at $6,082 per resident and a medium housing price of $153,900. However, Michigan struggles with a higher-than-national-average unemployment rate of 4.2%—about .8% above the national average.

8. Iowa

Best state to survive a recession 2020: Iowa

Iowa lands at No. 8 in our 2019 study, down one position from our 2017 study. It boasts per-capita exports of $4,555, which is slightly above the national average. It also has a strong debt-to-income ratio of 1.165—down from 2017 when it was 1.29.

There are other positive signs for Iowa: deposits per capita rose from $26,000 in 2017 to $28,000 in 2019 while its unemployment rate is 2.5%—the third best in the nation, following North Dakota and Vermont. It also has a median home value of $145,700—very affordable, considering the national average is above $200,000.

9. Georgia

Best state to survive a recession 2020: Georgia

Things are looking sweet for the Peach State, which lands at No. 9 for the best states to survive a recession—up from No. 35 in 2017. It boasts the fifth-lowest average debt-to-income ratio in the nation at 1.46, down from 1.66 in 2017. It also has 10% of total spending available as stabilization funds—the sixth best in the nation.

There’s more where that came from. Georgia’s unemployment rate dropped from 4.8% in 2017 to 3.6% in 2019, and its deposits per capita increased from $22,000 to $24,000 per year. The state also managed to create a well-diversified exports portfolio with products shipped to China, Mexico, and Japan, among other nations.

10. Tennessee

Best state to survive a recession 2020: Tennessee

Tennessee takes the No. 10 position for the best states to survive a recession in our 2019 study. Previously No. 18 in our 2017 study, this Southern state jumped onto the charts given notable improvements in its economic environment. This includes a drop in its average debt-to-income ratio of 1.285 in 2019—compared to 1.5 in 2017—and good economic diversity with the top industry in the state comprising a modest 16.4% of GDP, about 4% below the national average of 20%.

It’s also worth noting that Tennessee’s exports per capita reached $4,832—a bit above the national average of $4,299—with total exports also clocking in just above the national average at $32.7 billion. Add to that an unemployment rate that decreased slightly from 3.6% in 2017 to 3.5% in 2019, and you have the foundation of relative economic stability.

Definitive Ranking of All 50 States

|

Overall Rank |

State |

Total Score |

|---|---|---|

|

1 |

Texas |

35.375 |

|

2 |

West Virginia |

33.850 |

|

3 |

Nebraska |

33.775 |

|

4 |

Indiana |

33.475 |

|

5 |

Alabama |

33.350 |

|

6 |

North Dakota |

32.925 |

|

7 |

Michigan |

32.625 |

|

8 |

Iowa |

32.525 |

|

9 |

Georgia |

32.050 |

|

10 |

Tennessee |

31.775 |

|

11 |

Minnesota |

31.650 |

|

12 |

Ohio |

31.550 |

|

13 |

Delaware |

31.500 |

|

14 |

South Dakota |

31.275 |

|

15 |

Oklahoma |

31.000 |

|

16 |

New Hampshire |

30.925 |

|

17 |

South Carolina |

30.850 |

|

18 |

Louisiana |

30.775 |

|

19 |

Alaska |

30.600 |

|

20 |

Kansas |

30.200 |

|

21 |

Connecticut |

30.025 |

|

22 |

Massachusetts |

29.900 |

|

23 |

Vermont |

29.825 |

|

24 |

North Carolina |

29.450 |

|

25 |

Pennsylvania |

29.350 |

|

26 |

Colorado |

29.300 |

|

27 |

Washington |

29.100 |

|

28 |

California |

28.725 |

|

29 |

Arkansas |

28.625 |

|

30 |

Mississippi |

28.375 |

|

31 |

Missouri |

28.325 |

|

32 |

Illinois |

28.250 |

|

33 |

Virginia |

27.850 |

|

34 |

Wisconsin |

27.750 |

|

35 |

Kentucky |

27.500 |

|

36 - Tie |

Maine |

27.425 |

|

36 - Tie |

Utah |

27.425 |

|

37 |

Wyoming |

27.250 |

|

38 |

Oregon |

26.925 |

|

39 |

Idaho |

26.600 |

|

40 |

Maryland |

26.575 |

|

41 |

Rhode Island |

26.550 |

|

42 |

Florida |

26.025 |

|

43 |

New York |

25.900 |

|

44 |

Nevada |

24.950 |

|

45 |

New Jersey |

23.825 |

|

46 |

New Mexico |

23.600 |

|

47 |

Arizona |

22.625 |

|

48 |

Hawaii |

22.425 |

|

49 |

Montana |

21.200 |

Click here to see all data considered in our study.

Methodology

Our ranking of the best states to survive a recession in 2020 was based on 11 metrics. We analyzed the data for these metrics and assigned weights to each based on their relative importance to recession survival:

1. Fiscal Health & Stabilization Funds Available: 15%

To get insight into each state’s fiscal health, we considered the amount of stabilization funds each state has available. Stabilization funds are created to provide state economies a safety net when there are changes in revenue; they are often called “rainy day” funds. We analyzed the percentage of stabilization funds (as part of total spending) per state using data available from The Bureau of Economic Analysis, giving preference to those with the highest percentages of stabilization funds.

2. Economic Strength & Diversity: 15%

To help illustrate a state’s economic strength, we analyzed gross domestic product (GDP) and GDP per capita (to account for state population differences). We also factored in the top industry’s share of each state’s GDP to determine how dependent a state is on a single business area. This data was sourced from the Bureau of Economic Analysis

3. Debt-to-Income Ratio: 10%

The level of states’ per-capita debt-to-income ratio is a major indicator of how well a state will survive during a recession. When a recession hits the nation, each household will need money to cover expenses should incomes decrease and assets diminish. The more debt a household has, the larger the share of diminished income will necessarily be allocated to cover debt payments, while less will be available for day-to-day expenses.

To gauge a state’s existing debt level, we considered each state’s debt-to-income ratio using data from the Federal Reserve. We collected each state’s average low and average high debt-to-income ratios and calculated the average debt-to-income on a state-by-state basis.

4. Unemployment Rate: 10%

The higher the unemployment rates within a state, the more instability it generally faces. For this reason, we considered unemployment rates by state (using data available from The Bureau of Labor Statistics), giving preference to states with lower unemployment rates.

5. Median Home Value: 10%

When a recession hits, housing demand drops, and with that, home values—leaving those with significant real estate equity in financial straits. As a measure of a state’s ability to weather a recession, we therefore ranked states’ median home values as available from Zillow. Lower average home values received a higher score.

6. Exports per Capita: 10%

State governments depend on revenue—a key factor in their ability to manage a hit from a national recession. To a large extent, this revenue depends on exports. Therefore, we analyzed each state’s total exports and exports per capita. This data was collected from the International Trade Administration (ITA). States with the highest amount of exports per capita were ranked higher in our study.

7. Export Diversity: 10%

To avoid negative impacts on a state’s economy from unstable international trading partners, a diversified international trading portfolio was preferred in our ranking. To determine which states had the most export diversity, we collected data from the ITA.

8. Deposits per Capita: 7.5%

States that have residents with significant cash assets are more likely to survive a hard-hitting recession and continue spending—which will serve as a boost to local economies. Therefore, we gathered data on deposits in each state from iBanknet, which was then divided by population to get deposits per capita.

9. Average Credit Card Debt: 5%

States with high amounts of average credit card debt were considered prone to financial struggle during an economic downturn, given that residents would likely face even more debt—or at least reduced income that can cover debt—during a recession. Data on credit card debt was collected from the Federal Reserve; states with lower average per-capita debt were ranked higher in our study.

10. State Income Tax Rate: 5%

State income tax rates can quickly eat into the amount of disposable income citizens have available to cover day-to-day expenses—a key consideration during a recession when income is often reduced. For this reason, we collected state income tax rates from the Tax Foundation and gave preference to states with the lowest rates of income tax.

11. 2008 Recession Performance: 2.5%

While history does not always repeat itself, it sometimes does, and so we considered how each state performed in the last recession of 2008. To measure this, we analyzed and ranked states based on how their GDP was affected from 2008 to 2009 (source: Bureau of Economic Analysis). This metric received minimal weight given that past economic performance does not directly equate to future performance.

Bottom Line: Best States to Survive a Recession

Our research revealed that, generally, both Southern and Midwestern states are best equipped to handle the next recession. Our 2019 study—looking toward a possible recession in 2020—saw five new states make the top 10 list, including the No. 1 best, Texas. While half of the top 10 from 2017 remained on the list for 2019, they all changed positions. Regardless, what these states have in common is a healthy, diverse economy and financial stability, making them the best states to survive an economic downturn.

Read More

0 تعليقات