To learn how to open a bakery, you should start by writing a business plan, researching equipment costs, and finding a location. A bakery can be operated at home, in a shared kitchen, food truck, or cafe. Costs range from $5,000 for an at-home bakery to over $500,000 for a bakery cafe.

Every bakery that needs to accept payments from customers should have a point-of-sale (POS) system. A POS processes credit cards and provides other features to help manage the business, such as inventory management. Lightspeed is an easy-to-learn POS system that you can install on an iPad. With Lightspeed, you can also process online payment orders for your bakery. Sign up to get started with Lightspeed today.

Here’s how to open a bakery in six steps:

1. Research Your Bakery

The upfront research you do to better understand the bakery you want to open is vital. When you’re clear on the type of bakery you want and how much it may cost, it makes your goal clear and attainable. Additionally, when you know how much money you’ll need, you can make a strategic plan on how you will raise the funds to open your bakery.

Choose the Type of Bakery

Before taking any of the steps below, you must choose the type of bakery you want. You must first decide if your bakery will be retail, wholesale, ecommerce, or a combination. Deciding this early helps determine your equipment, location, and inventory needs. Retail bakeries serve customers at the counter. Wholesale bakeries serve other businesses, like restaurants, grocery stores, cafes, and delis. Ecommerce-based bakeries sell products online.

In addition to the overall type of bakery, you also need to choose the type of baked products you want to sell. Will it be a cafe that sells general baked goods for the average customer, or will you sell a specialized product like wedding cakes, cupcakes, or Bundt cakes?

Your Bakery’s Location Costs

It’s important to research location costs for the type of bakery you’d like to open. An at-home bakery would result in little additional cost. Moving into a location where a bakery recently left is a lower-cost option than purchasing a new building, because the build-out costs would be lower. Some bakers choose to open a food truck, which requires little to no rent, and simplifies traveling to events. Regardless of your location, do research on rent, utilities, and build-out costs.

“True high profile retail spaces can be extremely costly. The increase in rent and expenses may not provide bakeries with the additional revenue to maintain margins. A good rule of thumb is that the sale of goods over the counter should exceed $200,000 a year in order to justify a true retail location.”

– Bethany Babcock, Founder, Foresite Commercial Real Estate

Your Bakery’s Equipment Costs

When choosing your bakery’s equipment, consider purchasing used items. Pre-owned equipment can save you an average of 40% to 60% on all equipment. Equipment costs can range from $2,000 for an at-home bakery to over $200,000 when opening a franchise, like a Great Harvest Bread Company. Spend time conducting online research in addition to calling local equipment suppliers to compare costs.

Bakery Inventory Costs

Inventory won’t be a huge cost; however, it’s important to research local and national suppliers. To find a good cost benchmark, visit your local bulk supply shop like BJs or Costco and price all of the inventory you need. Then, call local vendors to get their prices on the inventory you need. You may have to utilize several vendors for different items like packaging and dough because certain vendors may only supply certain items.

Bakery Franchises

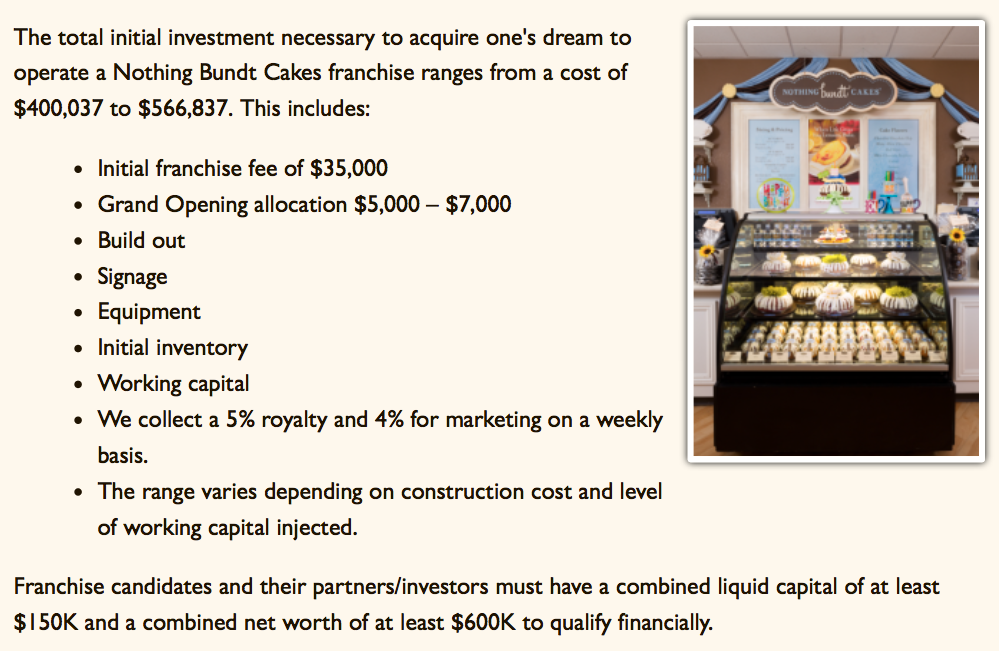

An expensive but lower-risk business option is opening a bakery franchise. Purchasing a franchise can be more expensive, because, typically, there is an upfront franchise fee with an ongoing 5% monthly royalty fee. It’s a lower risk because you receive the scalable recipes, marketing strategy, and proven business systems.

For example, Nothing Bundt Cakes charges a franchise fee of $35,000 and a weekly royalty of 4% to 5% of sales. Additionally, before purchasing, it requires owners (or investor groups) to have a net worth of at least $600,000, with $150,000 in liquid capital. The cost to open a Nothing Bundt Cake ranges from $400,000 to more than $550,000. This is an expensive option but is much less risky than developing your own business systems and marketing and branding strategies.

Franchise costs for Nothing Bundt Cakes varies depending on the size of the location and build-out expenses.

2. Write Your Bakery Business Plan

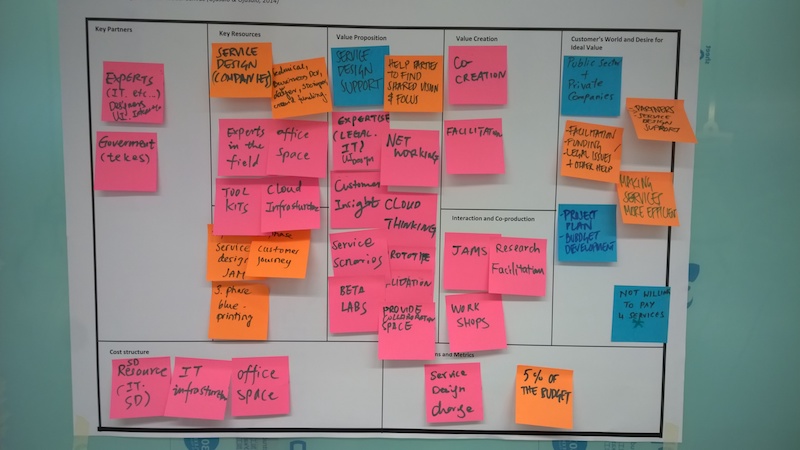

A business plan is the roadmap for your bakery. It includes market research, competitor analysis, and product information. If you’re not seeking funding, you may want to consider a shorter, leaner business plan like the business model canvas (BMC). In your plan, make your case as to why customers near your bakery will be attracted to your business. Use month-by-month financial projections to show how your business will succeed.

Traditional vs Modern Bakery Business Plan

The traditional business plan is a business report that most bankers and investors review before providing funding. A modern business plan, also called a business model canvas (BMC), has new sections like Value Propositions and Revenue Streams. Additionally, the BMC is visual; you can complete its core components on a wall with sticky notes (although you’d sacrifice some aesthetics). The downside of the BMC is that most banks won’t accept it as a business plan.

Regardless of whether you choose a traditional plan or business model canvas, it’s wise to provide thorough financial projections. Anyone lending money to a business is concerned about the financial projections first. The projections explain how much profit your bakery will earn and how the lender or investor will make their money back.

The business model canvas is often done with sticky notes as a leadership team exercise for a business.

Market Research for Your Bakery

Market research determines how risky it will be opening the type of bakery you want, based upon the local demographics and industry trends. You need to do research and present data that proves the industry is strong and that there are customers who will shop at your bakery. You can use the U.S. Census to access free demographic data and a paid tool, like IBIS World, for industry trends.

Competitor Analysis for Your Bakery

It’s important to show how your bakery stacks up against the local competition. To do a competitor analysis, choose five local competitors, ideally those located within a five-mile radius from where you plan to operate your business. List their distance away from your bakery, the advantages they have, and disadvantages. The disadvantages are what your bakery will do better than a particular competitor.

You Bakery’s Financial Projections

The financial projections are the most important part of the business plan. Unfortunately, they are also the most challenging to prepare. They consist of several financial statements that predict the financial health of the business over the next three years. For example, one financial statement you’ll need to prepare is the profit and loss statement that outlines the month-by-month revenue and expenses for the business. The Service Corp of Retired Executives (SCORE) provides a free Excel workbook you can use to create your financial projections.

Business Plan Software

Many business owners use a business plan software to help them create and organize the business plan, including the financial projections. A good software will also take the financial numbers you enter and create easy-to-read charts. LivePlan is a business plan software that takes users step-by-step through creating an investment-worthy business plan. Additionally, LivePlan provides a bakery business plan example to learn from.

3. Obtain Funds for Your Bakery

There are several options to raise the capital needed to open your bakery. Many bakery owners piece together several funding sources to open their business. For example, if an owner needs to raise $135,000, they may organize a crowdfunding campaign to raise $20,000, get an investor to fund $50,000, personally invest $50,000, and take out a personal loan of $15,000.

Secure a Bank Loan for Your Bakery

A bank loan is a sum of money, typically at least $100,000, that borrowers pay back every month with interest. If this is your first bakery, it will be difficult to secure a bank loan. Banks typically don’t lend to startups unless the borrower is willing to put the borrowed amount into an easily accessible account, like a certificate of deposit (CD) account. This is because the bank wants to collect the amount owed on the loan in the event of a business failure.

Additionally, bankers like to see that a borrower has experience in the type of business they are opening. If you don’t have management experience in a bakery, it is wise to find a partner who does.

“Obtaining bank financing can be difficult in the restaurant industry because it’s competitive and you don’t have two years of financial statements to put the bank at ease about your ability to pay back the loan. You should be prepared to present a realistic and polished business plan that includes real financial data from your launch to date, a detailed description of how the loan will be used to help you get to grand opening (remember to include equipment like ovens, refrigerators, and specialty utensils), how your revenue will provide enough cash flow to pay back the loan, and a timeline for repayment.”

– Travis Crabtree, President and General Counsel, Swyft Filings

Find an Investor for Your Bakery

Investors tend to be wealthy individuals who are looking to diversify their investments. They are a challenge to find, and it’s best to search for them through local networking. Typically, an investor will provide funds in exchange for ownership in the company.

Before trying to connect with an investor, make sure your business plan and financial projections are solid. You may want to have an accountant review the projections and poke holes in your thinking before giving the plan to an investor.

Take Out a Personal Business Loan for Your Bakery

A personal business loan is a loan under $100,000 that business owners borrow using their own names. A traditional bank loan is a secured debt and tied to assets, such as a cash account or equipment. A personal business loan is an unsecured debt and based on the borrower’s credit score, which typically gives the loan an interest rate between 12% and 16%.

Start a Crowdfunding Campaign for Your Bakery

Crowdfunding is a tool you can use to get customers to purchase goods or services in advance. Crowdfunding platforms call these purchase rewards. For a bakery, rewards would simply be selling your baked goods in advance. For example, Savage Goods Cafe raised over $30,000 on Kickstarter by preselling pastries and merchandise (koozies and T-shirts) at different reward levels. Crowdfunding platforms charge a fee of the final amount raised, typically around 5%. Keep in mind that you will also pay credit card processing fees of around 3%.

4. File Legal Paperwork for Your Bakery

There are several steps you must take to legally serve your customers. It’s wise to have the proper legal and insurance protections in place to safeguard the business and the owner’s finances. To do this, all bakeries need to be established as a legal business entity. Additionally, having the proper insurance is important, because it protects the business’ finances if an accident were to occur. You also need to obtain the necessary licenses and permits to avoid any fines.

File Your Bakery as a Legal Business Entity

Every bakery must file as a legal business entity. This protects the owner’s personal finances in the event that a lawsuit occurs against the bakery. Additionally, being established as a legal business entity protects the owner’s personal finances from creditors seizing personal assets, like a car or house, if the bakery were to go bankrupt. Examples of legal entities are the limited liability company (LLC), an S corporation (S-corp), and a C corporation (C-corp).

You can register for your preferred legal entity through your state’s website or through an online legal service. IncFile is an online legal service that files your business registration paperwork for you with the state. It costs $49 plus state fees, which range from $40 to $500.

Apply for Your Bakery Employment Identification Number

The employment identification number (EIN) is a unique number that the federal government gives all businesses. An EIN is used by the federal government for income and payroll tax purposes as well as by business owners needing to open a business bank account and apply for a bank loan. A bakery owner can apply for an EIN on the IRS website.

“My quick tip for someone starting a bakery, after they have incorporated or formed an LLC for the company, is to obtain an employer identification number (EIN) for the business. This federal tax ID is a requirement if you plan on hiring employees—which you probably will for the business. An EIN is a nine-digit number issued by the IRS to identify employer tax accounts and file business income tax returns. Even if you don’t hire employees, you may file for an EIN, especially if you incorporated the business because you will technically be considered an ’employee’ of that business since it’s now its own legal entity.”

– Deborah Sweeney, CEO, MyCorporation.com

Secure Necessary Bakery Business Licenses & Permits

There are several types of licenses and permits your bakery needs to obtain before it can open. Depending on your city or county, you may need a general business license to operate. Additionally, if your state has sales tax, you may need a sales permit.

Before serving customers, you will need a health permit from the local health department. If you have a physical location, the fire department may need to do an inspection as well. Ultimately, license and permit requirements vary by city, county, and state, so it’s best to check with the official business website for each.

Get Insurance for Your Bakery

Liability insurance protects the bakery’s finances in the event that a third-party accident occurs in the business or if someone becomes ill or dies from consuming one of its products. Liability insurance is not required by the state, but it is highly recommended to protect the business against costly accidents. Typically, liability insurance costs around $500 per year.

Workers’ compensation (comp) insurance protects the bakery’s finances in the case of an employee becoming injured on the job. This insurance is required in most states. Typically, it costs around $2,000 per year.

Open a Business Checking Account

Before incurring any expenses or spending money on your bakery, it’s important to open a business checking account so you can keep your business and personal finances separate. If your bakery were ever audited by the IRS, you’d want to be able to easily show the business income and expenses in one business checking account. Chase business checking provides safe and secure checking for bakeries. The minimum balance on a business checking account at Chase is $1,500.

5. Set Up Your Bakery Business Software

Using software will streamline processes in your bakery. An affordable payroll software, like Gusto, allows you to make direct deposits into your employees’ checking accounts. A point-of-sale (POS) system, like Lightspeed, ensures you can accept all types of credit cards and trendy payments like Apple Pay. You can also schedule employees to work with free software like Homebase.

Hire Employees for Your Bakery

Unless you’re a one-person bakery, you will need to hire employees. A good place to find potential employees is in your own network. Post the position for which you’re hiring on your personal Facebook page; this doubles as free advertising for your new bakery. Additionally, you can use a website like Indeed to post your jobs. Before hiring a new employee, be sure to conduct a thorough background check.

Pay Your Bakery Employees

Once you hire employees, you’ll need to pay them. Keep your payroll organized with a full-service software. Gusto is a payroll software that can help you manage not only payroll, but also time tracking, employee benefits (medical, dental, vision), and HR compliance. Try Gusto free for one month; after that, it’s $6 per person, per month plus a base price of $39 per month.

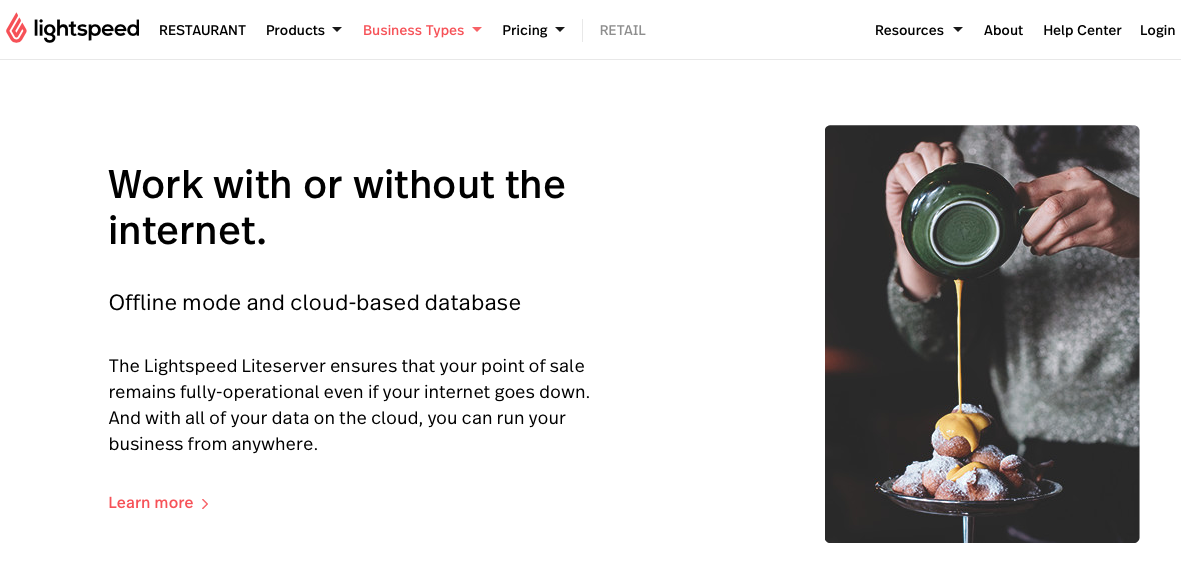

Purchase a Bakery Point-of-Sale System

A point-of-sale (POS) system is software that processes customer payments and assists with operational tasks like inventory management. For a bakery, it’s important to have a mobile POS system so that you can take it with you to events. Lightspeed is an easy-to-use POS software that can be installed on an iPad. If you’re opening a cafe, Lightspeed enables you to take an order from a table and transmit it to another iPad in the kitchen. Get started with Lightspeed for $69 per month.

Use Lightspeed POS to accept credit card payments even if the internet stops working.

Online Accounting & Billing System for Your Bakery

Many bakery owners hire bookkeepers or accountants to help manage their finances. You can also manage it on your own with an online accounting software. QuickBooks is an online accounting software that connects with Lightspeed POS to seamlessly record your revenue. Additionally, with QuickBooks, you can create and send invoices to customers with larger bills, like restaurants or delis.

Employee Scheduling for Your Bakery

If you’re opening a cafe bakery, you will have several employee schedules to manage. It’s helpful to have software assist with arranging employee work hours. Additionally, software can allow employees to sign up for shifts from their phone or computer. Homebase is a free and simple employee scheduling software built for small and medium-sized businesses, like bakeries.

6. Market Your Bakery

Now that you’re almost ready to open your bakery, it’s time to start letting potential customers know about it. You will want to create physical marketing materials, like signage and business cards. Online marketing, like social media and Google My Business, provide new opportunities to reach customers. Celebrate the start of your bakery with a grand opening.

Traditional Marketing for Your Bakery

Traditional marketing for a bakery generally includes physical materials, like business cards, signage, flyers, labels, and postcards. Before creating any marketing materials, it’s important to have a solid grasp of your branding strategy, which includes knowing the colors and overall style of your bakery. You want all of your marketing materials to match style-wise.

“The key to getting a new business off the ground is finding ways to advertise with little money. Cash flow is often non-existent and new budgets typically are devoted to equipment and payroll. But there are ways to advertise your business and create a positive image for future sales.

“Customize giveaways that are appropriate for your bakery and distribute them to customers who patronize your business the first week or month. I would suggest giving out a donut stress ball with each purchase. Place your name, logo, and contact information on the stress ball for long-term advertising and exposure. Think about it: Everyone who sees those stress balls will learn about your bakery! It’s cheap but effective advertising and branding.”

– Shelley Grieshop, Creative Writer, Totally Promotional

Online Marketing for Your Bakery

Online marketing is constantly changing and presents you with an opportunity to learn about the latest trends so you can get ahead of the competition. One great aspect of online marketing is that if you manage it yourself, you can pay little to no money to start.

Here are a few online marketing opportunities:

- Website: A website is important to have for your bakery. Whatever website you choose, make sure it follows a modern design with less text and large photos. You may also want your website built in a way that allows it to process online orders.

- Social media marketing: A bakery will benefit from being on Instagram, because it is a visual business. Use video marketing on Instagram and Facebook Stories to show how the products are made.

- Google My Business (GMB): This is a free listing that all businesses with a physical location receive from Google. There have been many innovations with the GMB listing in the past few years, and now it’s similar to a social media profile.

Google My Business allows you to upload photos and videos about your bakery in addition to important information like address, hours, and phone number.

To be successful with any of the online marketing opportunities above, it’s helpful to have quality photos and videos. A smartphone purchased in the last few years can take quality photos and videos. You don’t have to hire professionals to do either. Just remember that if you’re creating your own photos, make sure they are not dark or blurry; also, videos shouldn’t be shaky or have poor audio.

Grand Opening for Your Bakery

Most bakeries benefit from a grand opening, which is an event that can be as short as a couple hours or as long as an entire week. Typically, a grand opening is a party-like atmosphere with giveaways and discounts. The local press is often invited to cover the story of your new business. You may also want to advertise your grand opening in print and online.

Bakery Press Release & Media Kit

A press release and media kit are great marketing tools you can use to educate the local newspapers and TV stations about your bakery. The press release is a formatted document describing your bakery and its story. The media kit is more visual and should include a menu, photos, and other physical marketing materials. If you’re having a grand opening, you can promote that event in the press release.

Frequently Asked Questions (FAQs) for How to Open a Bakery

This section includes the most frequently asked questions about how to open a bakery. If you don’t see your question, head over to our forum and post your question there. We have a whole team of industry experts who answer questions from small business owners every day.

How much money does it take to open a bakery?

The amount of money it takes to open a bakery depends on the type of bakery you’d like to open. If it’s a side business and you’re baking from home, you can start for under $5,000 with used equipment and a small amount of ingredients. If you’re looking to start a bakery cafe where customers can sit and enjoy their pastries, that will likely cost a minimum of $200,000. A bakery franchise like Nothing Bundt Cakes can cost over $500,000.

Is a bakery profitable?

Yes, a bakery can be profitable; however, you must do your due diligence and figure out what your expenses are so that you can price your products to ensure you make a profit. Typically, you want to mark up the average pastry by 50%, so if the ingredients cost $2, you charge $4. It’s important to remember that some items may have a 25% markup while others have a 200% markup, but you should shoot for an average of 50% across all products.

How much money does a bakery owner make?

There isn’t a lot of data online about the average income of a bakery owner. Instead of focusing solely on an income number, go through the exercise of figuring out what needs to be done to reach your desired salary. For example, if you’d like to earn $50,000 a year, how many baked goods would you need to sell each year to reach that number?

Additionally, think outside of just walk-in customers. Many successful bakeries sell to local restaurants, corporations, delis, and stores in addition to walk-in customers. You may find that you earn more revenue from selling to other businesses than directly to customers.

How do you price a bakery?

Typically, you want to price your bakery items with a 50% markup. Figure out how much it generally costs to make a pastry or other menu item and double it. If it costs $10 to make a cake, sell it for at least $20. In retail, that is called keystone pricing, which is essentially doubling the cost or wholesale price of an item.

Not all items need to be keystone priced. Some common items, such as cookies, may only have a 25% markup, and more unique items, such as macaroons, may have a 200% markup. It’s wise to shoot for an average of a 50% markup.

Bottom Line

A bakery is a challenging but very rewarding business that puts smiles on customers’ faces. When figuring out how to open a bakery, start with research to determine the type of bakery you’d like to open and its associated costs. Develop relationships with multiple vendors to ensure deliveries are never delayed. At some point during your first week in operation, celebrate by hosting a grand opening and offering discounts and deals.

Every bakery that sells directly to customers needs a point-of-sale system to process credit card payments. Ideally, a bakery needs a mobile POS system so that it can be taken to special events, like a festival or farmers market. Lightspeed is a mobile, iPad-based POS software that is easy to use. It also comes with detailed reporting to quickly learn which pastries and products are selling and which are not. Get started with Lightspeed for $69 per month.

Read More

0 تعليقات