When deciding how to open a bar, you should begin by researching different types of bar businesses (sports bar, pub, brewery). In general, bars can be expensive to start, with costs ranging from $150,000 to more than $1,000,000, depending on how much space and the type of liquor and food licenses required.

To accept and process credit card payments at your bar, you’ll need a point-of-sale (POS) system. A POS system is typically a tablet or small register station where bartenders swipe a patron’s credit card. ShopKeep is a POS system that is specifically designed for bars. In addition to accepting payments, it comes with features such as bottle inventory management, staff tracking time, and built-in tip reporting software for bartenders. Sign up with ShopKeep for $69 per register per month.

Here’s how to open a bar in six steps:

1. Research Different Types of Bars And Costs

The first thing you need to do before opening your bar is research the different types of bar you may open and their associated costs. You shouldn’t start by making any major decisions or spending money on your bar—only doing research. You need to look into costs related to buildings you may use, state licenses, equipment, and bar staff. Knowing the costs you’ll need to cover before starting will help when you begin writing your business plan and determining how much capital you’ll need to acquire.

Choose the Type Of Bar You Want

It’s important to get clear and zero in on the type of bar you’d like to open. Common bar types include sports bars, neighborhood pubs, breweries, dance clubs, and wine-based bars. Each one of these businesses has different features and therefore different costs. For example, a brewery will most likely cost more than a sports bar, because beer brewing equipment can be expensive.

In addition to determining the type of bar you’d like to operate, deciding whether you’ll build your bar from scratch, purchase an existing bar, or a franchise is also important. Purchasing an existing bar may require more startup costs than building one from the ground up, but it will come with branding, a customer base, and existing systems; it should also already be profitable.

Franchises are another option and can be expensive as well. For example, the World of Beer franchise requires business owners to have an overall net worth of over $1 million and pay a $50,000 franchise fee, an ongoing 5% of net sales in royalty fees, and 1.5% of net sales in marketing fees.

Bar Location Costs

Another important decision to make is whether you’re going to rent a location out of which to operate or purchase a building outright. Purchasing a building will require more capital and be a lengthy process. If you go that route (purchasing a building), it’s a best practice to gather quotes from several general contractors regarding the build-out, which includes both interior and exterior construction costs. To set the bar up the way you want, you may need to pay for structural work, like moving air ducts.

“The No. 1 tip we give bar owners is this: ask an experienced general contractor (GC) to look at your potential location BEFORE you sign the lease. A good GC can identify any issues with the space in advance so you can make an educated decision on how to best move forward. Should you negotiate more amps of power for your electrical needs? What are the anticipated build-out costs? It’s a great reality check on your vision before you commit.”

—Tim Spiegelglass, Co-Owner, Spiegelglass Construction Company

Beer & Liquor License Expenses

You’ll need a beer and/or liquor license before serving alcohol in your establishment; its verification of the city and state’s approval that your business can legally sell alcohol. The costs for a beer or liquor license depends on several factors, including the type of bar you’re opening, your state’s regulations, and the types of licenses required. The cost of full liquor licenses ranges from $300 to $14,000 with the average cost around $1,500.

Regardless of the state you’re in, you will need an “on-license” liquor license, which is for businesses selling alcohol intended to be consumed on the premises. Examples of the different licenses required for bars are tavern licenses, which are for businesses that receive the majority of their revenue from alcohol sales, and restaurant licenses, which permit establishments to sell alcohol but limit the percent of total revenue they can receive from alcohol (typically under 50%).

Equipment Costs

There are several pieces of equipment you must purchase before opening a bar, including refrigeration, a draft beer dispenser, underbar sinks, a commercial glass washer machine, and a point-of-sale (POS) register. On the low end, you might pay around $30,000 for bar equipment. If you’re adding a kitchen, however, your equipment costs could exceed $200,000.

Additional Expenses

Depending on the type of bar you’re opening, you may have additional costs. For example, it’s easy to justify the cost of 10 big screen T.V.s for a sports bar. Additionally, if you want to remain competitive, you may need to follow current trends in the world of sports bars like having small, personal televisions at each booth. Even purchasing a sports channel package could cost hundreds of dollars a month. As another example, a bar that specializes in high quality music and live bands will have audio equipment and stage costs.

Utilities will be a large expense as well. Electricity and water costs vary depending on how large of a location your business will occupy. Typically, you’ll want to budget around $500 per month for internet, phone, and cable. Business Services Connect works with several internet and phone services to connect you with the right provider based on your geo-location. Secure your bar’s internet and phone service today with Business Services Connect.

Visit Business Services Connect

Bar Staff Costs

A benefit of running a bar versus a traditional business is the lower restaurant payroll costs for which you’re responsible—tips make a big difference. The minimum federal hourly wage for tipped employees is $2.13 an hour. A good rule of thumb you can use to estimate staff costs for a typical bar is expect expenses to be at least 22% of expected revenue. For example, if you’re expecting revenue to be $3,000 for a night, payroll costs should be around $660 (22% x $3,000).

“After helping bar owners over the past 20 years, the best advice I can give someone opening a new bar is to never hire family and friends or put blind trust in anyone that handles your inventory and money. I’ve seen bar owners being robbed blind by not only employees, but friends, girlfriends, business partners, siblings, and we even caught one bar owner’s mother stealing from them.”

—Kyle Odom, Owner, Bar Cop

2. Write Your Bar’s Business Plan

A business plan is the strategic road map you should follow when opening your bar. Before you start, you’ll need to choose the type of business plan you want to create—there’s the traditional plan vs a more visual modern one. Regardless of the type of plan you choose, you’ll need to include a financial projection section showing how much income and expenses you expect to flow through the business over the first three years. You may want to purchase a business plan software to walk you step-by-step through the process.

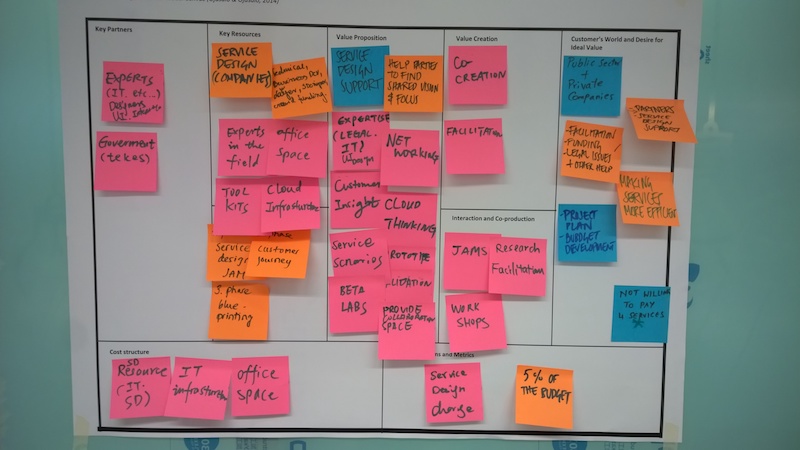

The Modern Business Plan

A modern business plan is an update to the traditional business plan that’s been used for over 100 years. A popular modern plan is the business model canvas (BMC). The BMC has updated sections that cover a range of topics, such as the value proposition, key channels, and customer relationships. Many businesses prefer the BMC because it can be used as a visual team building exercise. The downside of using a BMC is many banks won’t accept it as an official business plan.

The business model canvas is a planning exercise the whole leadership team can participate in

The Traditional Business Plan

A traditional business plan is similar to a business report that makes the case—using data—as to why your business will be a success. This plan includes sections like the Executive Summary (an overview of the business), Market Analysis (demographic research of your potential customers), and the Marketing Strategy. Most banks and investors require a traditional business plan before investing in your business.

Market Research

Whether you create a traditional or modern business plan, it’s wise to do market research. This is what you’ll use to prove your business will be a success. You’ll want to use information from a paid report, like IBIS World (around $1,095 per report) to show that the industry the bar is in is growing. Additionally, you’ll want to show that your target customers live near your business’ location. Use a demographic database, like ReferenceUSA, which is free at thousands of libraries across the US, to gather customer demographic information.

Competitor Analysis

In a business plan, it’s important to show who your competitors are, what they do better than your business, and what your business will do better than theirs. Some businesses claim they don’t have direct competitors, which is a red flag for many investors. No competitors may mean there aren’t enough customers in your area to support the type of bar you want to open. If you don’t have any direct competitors, explain in detail why that is so.

To show your competitor analysis in a business plan, you’ll need to include the following information, ideally in a chart:

- Competitor names: List at least five competitors within a five mile radius of your business (expand radius if necessary).

- Location of competitors: State how far each business is from yours in miles.

- The competition’s strategic advantage: Discuss what each competitor does better than your business (advantages).

- Your business’ strategic advantage: Discuss what you will do better than each competitor (disadvantages).

Financial Projections

The financial projections section is the most difficult and most important part of a business plan. This section is where you show how much money the business will earn (income) and spend (expenses) during its first three years in operation.

You’ll need to include several financial reports, like a profit and loss statement (which gives a detailed look into how your business plans to earn a profit—expected product sales) and a cash flow statement (that shows how cash flows into and out of your business). Use the free financial projections Excel workbook from the Service Corp Of Retired Executives (SCORE) to document your financial projections.

Business Plan Software

Many business owners who struggle with creating their financial projections on an Excel workbook choose to use a business plan software instead. A business plan software walks users step by step through the plan creation process, including financial projections. You can enter financial data and have the software turn it into tables and easy-to-read charts. LivePlan is the most popular business plan software and provides educational video tutorials. Get started with LivePlan today for $19.95 per month or $140 for annual plan (11.66 per month).

3. Raise Capital For Your Bar

Opening a bar is a fairly expensive undertaking. Most entrepreneurs start their bars using a loan or funding from an investor. Often, starting a bar requires several sources of capital, such as the owner’s personal savings, an investor (or investors), and a bank loan. Another creative option to raise money for a bar is to start a crowdfunding campaign.

Secure A Bank Loan

Banks typically don’t lend to startups, especially not bars and restaurants, because they carry a lot of risk. If you’re seeking a bank loan for a startup bar, you’ll need to have enough money, at least the amount of the loan, in an easily accessible account such as a certificate of deposit (C.D.). Banks require this, because they want to ensure they have a way to recover their loan if the bar goes out of business.

Take Out A Personal Loan

A personal loan is different from a traditional bank loan because it is a smaller amount (under $50,000), and the interest rate is higher (12% to 16%). A personal loan’s interest rate is higher because, unlike a bank loan, it isn’t secured by collateral. The interest rate is based on the borrower’s credit score. A personal loan won’t be enough to open a bar, however, it could be part of a larger financial package used to open a bar.

Find An Investor

An investor would give money to you in exchange for equity in your bar business. He or she would in turn receive a percentage of the profit every year, depending on their percentage of ownership in the business. Additionally, if the bar is sold, they receive a percent of the profit from the sale. It’s challenging to find an investor, but a good place to start your search is through local networking groups. Before approaching potential investors, make sure you have a high quality business plan with well-thought out financial projections.

Run A Crowdfunding Campaign

A crowdfunding campaign is what a business uses to raise money by promising future goods or services sold as rewards. For a bar, a reward could be pre-sold drinks like cocktails or wine. Rewards for a startup bar might also be swag-related, like a T-shirt or koozie. To start the crowdfunding process, you’ll need to use a crowdfunding platform like Kickstarter; it charges 5% of the final amount of money you’re able to raise plus a 3% payment processing fee.

Examples of successful bar-related crowdfunding campaigns include the Bark Bar in Little Rock, Arkansas, which raised over $13,000, the Calave Wine Bar in Palo Alto, California, that raised over $50,000, and the New Bohemia Brewing Co in Santa Cruz, California, that raised over $36,000 for its beer-based bar.

4. File Your Bar’s Legal Paperwork

After making some major decisions about the direction your bar is headed, including how you will fund it, you should set up the legal paperwork and obtain proper licenses. You’ll need to register your bar as a legal entity and request a sales tax identification number with the state (if your state has a sales tax). Additionally, you’ll want to obtain property licenses to open, such as the certificate of occupancy, which certifies the building is following local building codes.

“Apart from acquiring beer and liquor licenses, opening a bar is like opening most businesses. Determine the best entity structure for liability and tax purposes. A CPA firm can help. During your initial meeting with them, register with the Secretary of State’s office, if needed, and get a Federal ID number for your business. Contact an attorney to get a formal operating agreement—mandatory if you have a partner, but important even if you’re an individual operating the business.”

—Greg A. Lemons, Owner & CPA, Padgett Business Services

Obtain Employment Identification Number

The employment identification number (EIN) is a number the federal government gives out to all US-based businesses. The number is used to identify a business when it files taxes with the federal government. Additionally, most banks require businesses to have an EIN before opening a bank account.

Register Your Bar As A Legal Entity

All bar owners need to register their business as a legal entity with their state. Examples of business legal entities are the limited liability company (LLC), which provides protection for a business owner’s personal finances if the business were ever sued, and the S Corporation, which is similar to the LLC but has shareholders and is more appealing to outside investment.

In addition to personal financial liability protection, establishing your bar as a legal business entity would protect your personal assets from creditors if it ever went bankrupt.

The cost to register you bar varies state-by-state. For example, LLC business registration in Kentucky costs $40, but in Massachusetts, it’s $500. Typically, the cost to register a business as an LLC is around $150.

You can register your business as a legal entity through an online legal service. These online companies organize and submit paperwork to the state on your behalf. IncFile is an online legal service with a safe and affordable LLC registration. Let IncFile register your business for only $49 plus state fees.

Receive Proper Licenses

To open a bar, you’ll need several licenses. The liquor license is discussed above. The costs and availability vary by state and city. It’s best to go directly to your state’s official business licensing website. If you’re serving food, you’ll need a food service license, which is issued by your city’s health department and costs around $500. The food service license is a stamp of approval you receive after a city health official inspects your bar for food code infractions.

It’s likely that your city requires a certificate of occupancy before you can open your bar business, which certifies that the building has been properly maintained and can safely host guests. You may also need a sign permit from your city, which will be useful when you need to promote your bar. If you’re playing live music, that may require an entertainment and music license as well.

State Sales Tax Identification number

Most states require businesses (including bars) to charge a sales tax. Similar to an EIN, if your state charges a sales tax, you’ll need to register your bar with the state to receive a sales tax identification number. Typically, there’s no cost to apply for and receive the ID. To start the registration process, visit your state’s official tax website.

Open a Bank Account

Before accruing expenses for your business, it’s a best practice to open a business bank account. From the beginning, you should separate all personal and business finances. If the IRS decides to conduct a federal tax audit, you’ll want to clearly show that you and the business are separate entities. If a business tax audit occurs and your finances aren’t separated, you’ll have to spend additional time tracking down specific expenses in both your personal and business checking accounts.

Chase bank offers safe and secure business checking account services. Its accounts require you maintain a $1,500 minimum balance, or you’ll incur a small monthly fee, common among business checking accounts.

5. Purchase Software For Your Bar

There are several types of software you need to purchase for your bar. Learning how to use a quality software will save you time and make your bar more efficient. A point-of-sale (POS) system allows you to accept credit card transactions quickly and manage inventory. Bar staff scheduling software allows staff to sign up for shifts online; you won’t need to actively coordinate schedules.

Point-of-sale System

A POS software is very helpful for bar management. A quality POS system not only processes credit card transactions, but also includes tools for bottle and food inventory management, sales analytics (which can be broken down by bartender), menu options, and staff management, like the ability to clock in and out. If you’re giving bartenders the option to give customers discounts, you can track how much each staff member gave out in discounts.

“One area that I think gets overlooked is a good inventory management system. Heavy pours and ‘on the house’ for friends can seriously undermine profits. We had a client who couldn’t figure why he was going through so much alcohol given his sales. His margins were out of whack. For a week, we set up daily inventory reconciliation, and we quickly found the cause. When the employees were being held accountable, lost sales due to ‘shrinkage’ fell by 35%. It’s a fine line between the added labor versus the lost profits. We settled on biweekly reconciliations.”

—Brian Cairns, CEO, ProStrategix Consulting

Accounting Software

An accounting software helps track income and expenses for a business. Some business owners hire a bookkeeper. If you’re not hiring a bookkeeper and planning on managing the bar’s finances yourself, you’ll need an accounting software. QuickBooks is an accounting software that stores information securely in the cloud. You can start using it for $20 per month if you’ll only have one user.

Pay Your Bar Staff

Payroll software is used to pay and manage your bar staff. Use a payroll software to set up direct deposits and ensure your staff is paid on time. Gusto is a small business payroll software that does more than simply pay your staff. You can use Gusto to set up employee benefits like medical, vision, and dental. It costs $39 per month plus $6 per person.

Bar Staff Scheduling Software

It’s likely you’ll have several staff members working at your bar. You’ll need to manage when their shifts are. An employee scheduling software can assist with that. Use software such as Homebase, to track all shifts online. Additionally, bar staff can download the app and sign up for the shifts they are available to work. Homebase’s basic plan is free to get started for one location.

“Make sure to get a good scheduling system in place for bar staff to ensure streamlined communication. Scheduling on pen and paper isn’t effective in today’s world and leads to higher employee turnover. Ensure your schedule is easy to communicate or publish and also tracks employees’ availability and requests for time off.”

—Jacey Lamb, Inbound Marketing Specialist, ShiftNote

6. Market Your Bar To Customers

To pack your bar with customers, you’ll have to actively market it. Before purchasing any physical marketing materials, you’ll need to decide what brand you want to create and make it consistent across marketing items. You’ll also want to set up your online profile so when customers search for your bar on the web, it looks appealing.

Branding Your Bar

Before creating any marketing materials for your bar, it’s important to get clear on branding. Branding is overall feel and essence of your business’s marketing. This includes your bar’s colors, fonts, logo, interior design, taglines, and messaging. It’s also what makes your bar unique compared to competitors. Many bars hire a branding consultant or a marketing company to help them create their overall brand.

Physical Marketing Materials

Your bar will most likely have physical marketing materials, like flyers, promotional cards, business cards, signage, and advertising. This type of marketing is important when you’re attending networking events. For example, if you have a tent at a local community event, like a festival, you may want to give away or sell sunglasses, koozies, and T-shirts with your bar’s branding on it.

Online Marketing

Online marketing is a great way to reach new customers. It’s always changing, and if you’re aware of the latest trends, you can reach new customers on channels your competitors are not. Look to Instagram Stories and Google My Business posts as new ways to reach customers online. Additionally, your bar will need a modern website, social media pages, email marketing, and an optimized Google My Business listing.

“One of the best things you can do when opening a bar is to take a look at your competition online. Look at the bars in your area that are ranking on Page 1 of Google, and see what’s unique about them. You’ll of course want to be sure that you order the right libations and create a welcome decor, but you also need to think about your website. This is where your potential clients will find you. So be sure that you optimize your pages for search engine optimization (SEO), and try to acquire local backlinks to build awareness.”

-—Tom Buchok, Founder, Mailcharts

Grand Opening

A grand opening is an event you have to celebrate the opening of your bar. It can last a few hours or a whole week. It’s a great marketing opportunity that can be promoted on social media, in print, on billboards, and with signage in front of the bar to let local customers know you’re open. During a grand opening, there are typically deals and discounts that customers can take advantage of, such as buy one get one (BOGO) drinks or happy hour specials for the entire day.

Frequently Asked Questions (FAQs) For How To Open A Bar

This section includes the most frequently asked questions about how to open a bar. If you don’t see your question, head over to our forum and post your question there. We have a whole team of industry experts who answer questions from small business owners every day.

How much does it cost to open a bar?

It can cost anywhere from $150,000 for a small neighborhood bar to over $1 million for a larger bar or nightclub. The costs include interior build out that is required for a bar such as under the bar sinks and refrigeration. Additionally, permits and licenses can cost tens of thousands of dollars to obtain. An upfront inventory cost will be a minimum $10,000 for glasses, and alcohol. Rent and payroll are large expenses as well.

What licenses do you need to open a bar?

There are several licenses to consider when starting a bar. The type of licenses you’ll need depends on the type of bar you’re opening. For example, if you’re selling food, the employee health permit will ensure your employees are trained to handle food. Additionally, you may need a live music license if you will be having live music in your bar. All bars will need a certificate of occupancy from the local zoning department to confirm the building has been properly constructed.

How do I start a bar with no money?

To start a bar with no money you’ll have to find an investor and possibly start a crowdfunding campaign. If you personally have no money to invest, it will be a challenge to find an interested investor unless you personally know someone. If you have extensive bar management and business ownership experience, you may be able to find a silent investor. A silent investor may be interested in the status of owning a bar with little interest in the day-to-day operations and decision making a bar requires.

Additionally, you can run a crowdfunding campaign to raise money. To make a crowdfunding campaign successful, you’ll need a large local network of people who want to see your bar open and will donate to your campaign. Regardless of how large your network is, it’s unlikely you’ll raise the $150,000 it will take to open a small neighborhood bar, so it’s wise to seek an investor as well.

Is running a bar profitable?

Yes, running a bar can certainly be profitable. Making it profitable requires several skills, such as marketing, smart hiring, operational management, and pricing. Overall, it’s important to get customers through the door, minimize expenses, and charge enough for drinks and food.

Bottom Line

Running a bar can be a fun and exciting business. Before opening, it’s important to create thorough financial projections so that you know what it will take financially to make your bar a success. You should also secure the proper licenses along with appropriate software and business systems so your business operates smoothly even if you’re not present.

A great tool to help manage your business is a point-of-sale system (POS). Use a POS to accept credit cards, review sales analytics, and manage alcohol bottle inventory. ShopKeep is a POS system built with a bar and restaurant in mind. It’s fully customizable so you can set different prices for happy hour and drink specials. Additionally, its menu is easy to use so staff can quickly navigate. Start using ShopKeep today for $69 a month per register.

Read More

0 تعليقات