The term “startup” gets casually thrown around by so many people and so many organizations that it’s hard to know what the heck it means. Here’s a clear definition: a true startup is a business that is laser-focused on accelerated growth, increasing revenue from 100x to 1,000x current levels.

In recent years, the valuation cap that separates a startup from a company has increased because the amount of funding startups receive has massively increased. In 2019, over 50 startups received at least $250 million in a round of funding—a breathtaking amount of money for businesses that may or may not turn a profit.

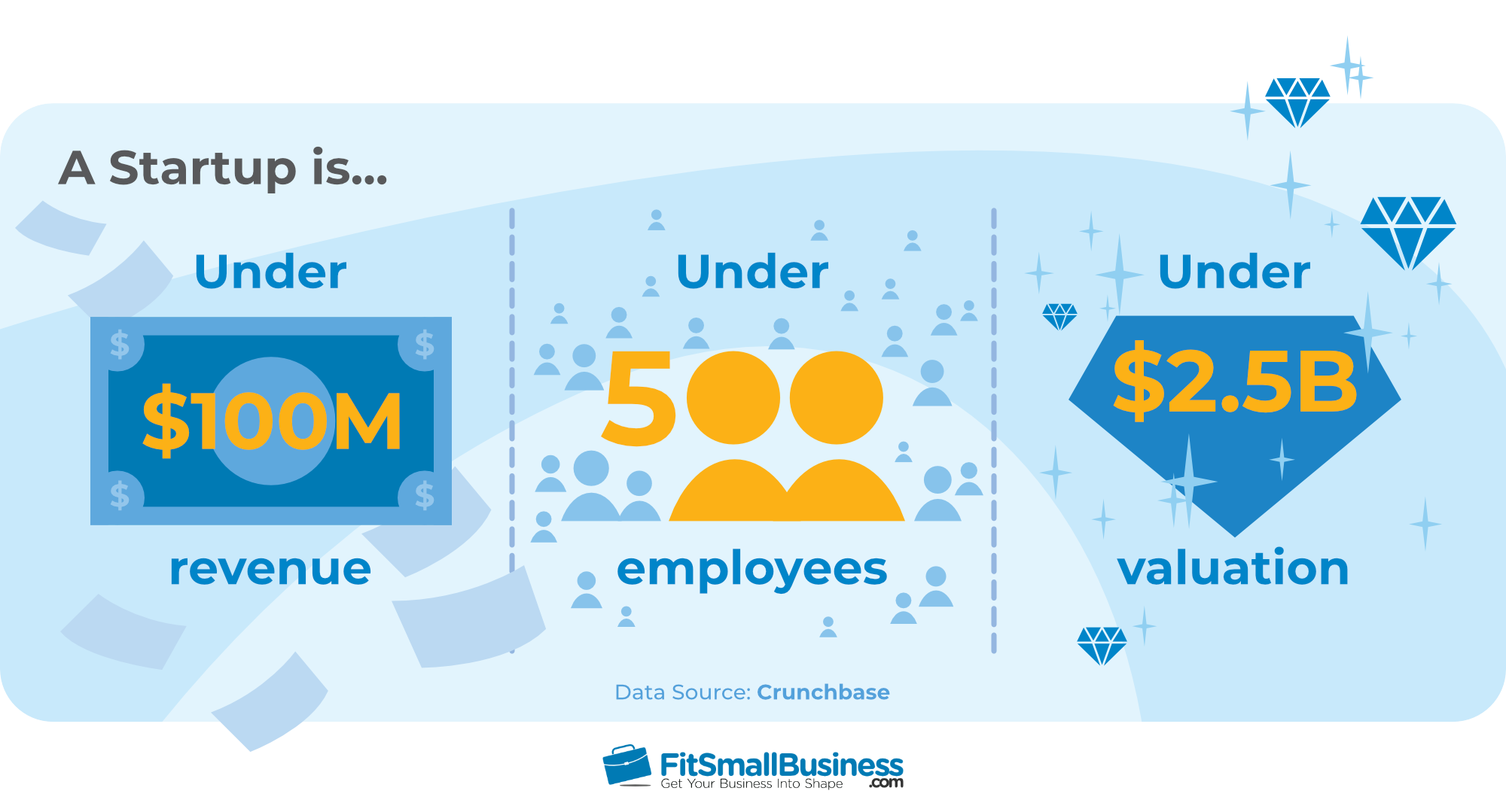

Today, a startup is still considered a startup if they have under $100 million in revenue, under 500 employees, and under a $2.5 billion valuation.

Growth Defines a Startup

The common trait that defines a startup is growth—fast growth.

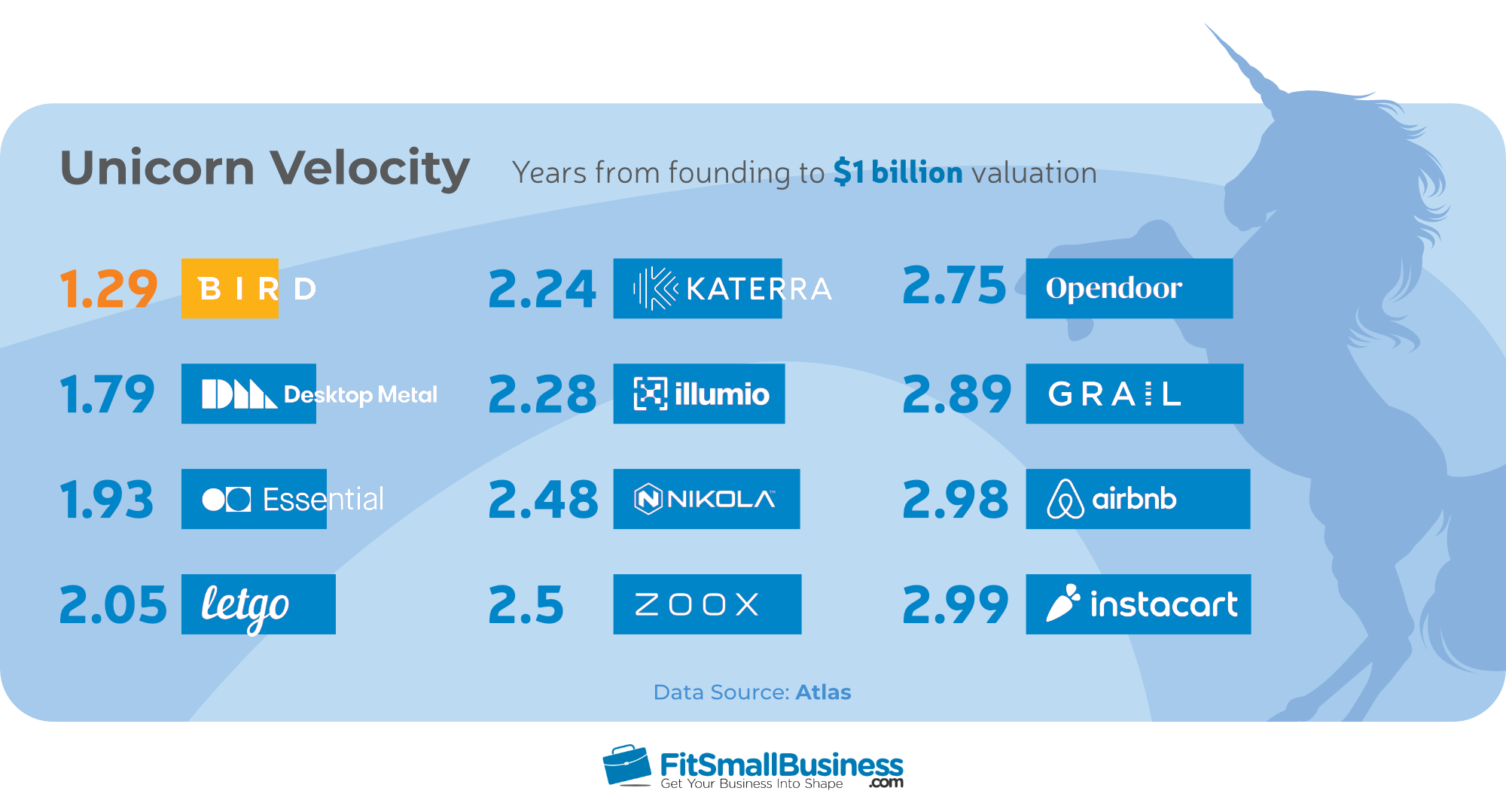

There’s a term for a startup that is expected to grow revenue at a higher than average rate. It’s called a unicorn. A unicorn is a startup that has achieved the rare $1 billion market valuation. Bird, the electric scooter company, is the fastest company ever to reach unicorn status, as shown below:

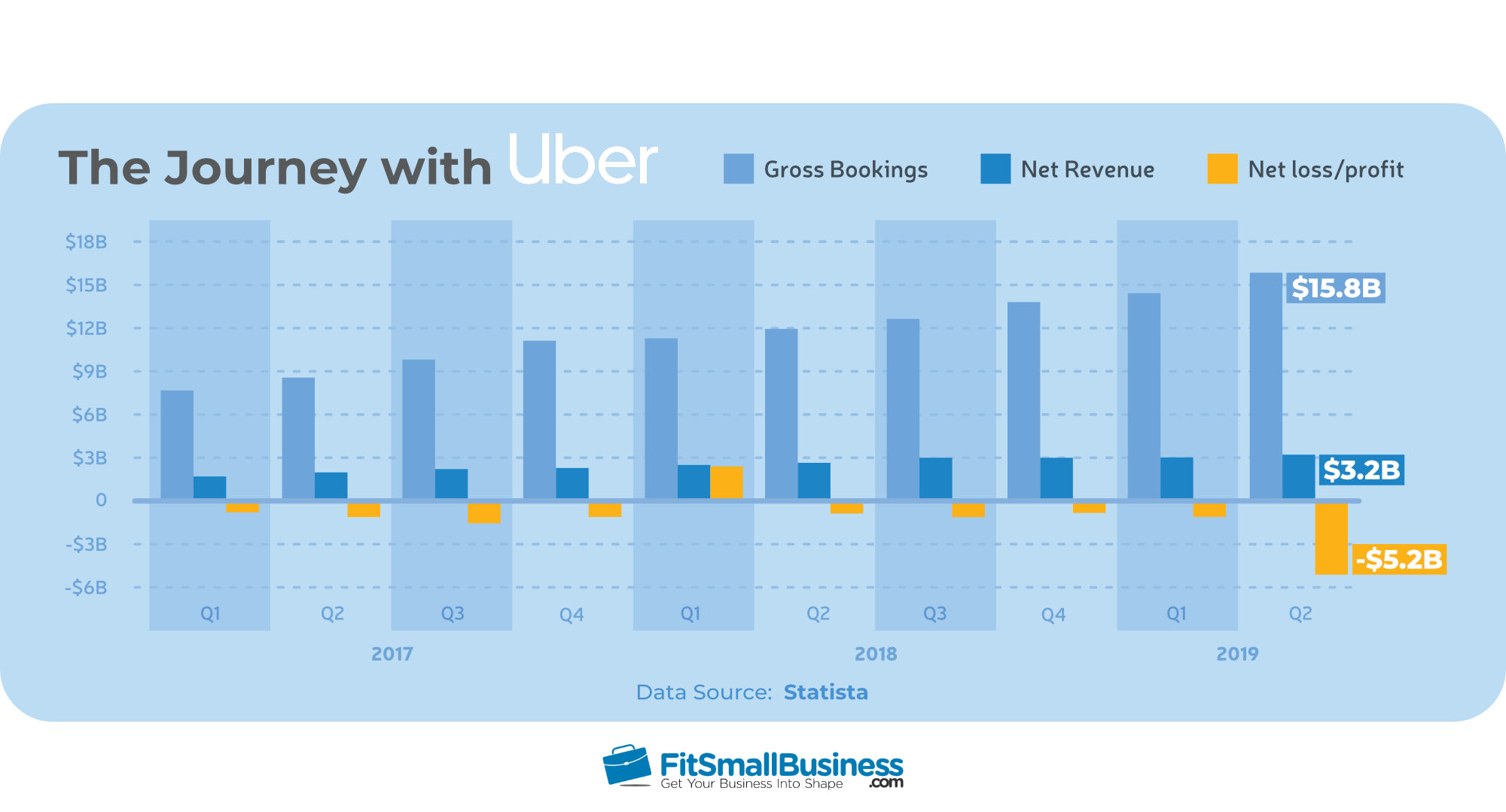

One complaint investors have about the obsession with growth is a focus on revenue and not profit.

Companies that make a lot of money, but don’t keep any of it for profit will become successful eventually, right? But what if they don’t?

Uber has been making more money than ever, but they’re also losing more money than ever:

Business stability is why many investors choose to invest in startups that focus on profitability over revenue growth. Typically, quickly profitable startups are less risky; they are saving a portion of profits to build a cash reserve. These startups aren’t spending all the profit on a growth tactic like paid ads or discounts for new customers.

Investors may seek out companies in industries that are likely to turn a profit quickly such as ecommerce, Chrome extensions, mobile apps, enterprise SaaS, and small-to-medium business SaaS.

Startup Investing and Funding

If a startup wants to grow quickly, it needs funding. The process of funding in the high-growth startup world can be confusing with terms like bootstrapping, seed funding, angel investors, Series A, and Initial Public Offerings (IPOs).

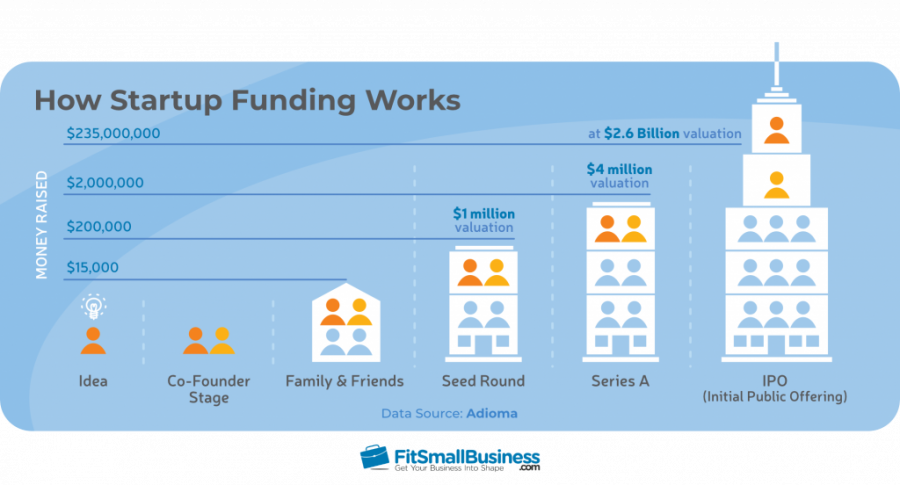

Before we dive into the different types of funding, here’s an overview of how startup funding may work:

Valuation

The valuation of a startup is how much the company is worth. There are several methods to determine the valuation of a startup, but the true test of a company’s value is what an investor is willing to pay for a percentage of ownership in the company.

For instance, if an investor offers $1 million for a 20% stake in the business, the investor (and therefore the market) believes the business is worth $5 million.

Two concepts you need to understand about valuations are pre-money valuation and post-money valuation. Pre-money valuation is what the startup is worth today. Post-money valuation is what the startup is worth after receiving the additional funding. Investors make offers in post-money valuations.

Investing Rounds

Many early startups begin with the founders’ personal investment, family and friends investment, or a seed investment from an angel investor.

An angel investor is someone who invests in the early stages of companies. Their investments are typically smaller (less than $200,000) because the potential success of the company is not yet understood, and the risk of failure is high. This early seed money is used to implement the MVP.

Once the startup grows, more investment funds are needed. Series A is the first round of large funding. If the startup continues to grow, they may have several rounds of funding including Series B, C, D, E, and so on.

Once the company has consistent revenue with a little profit, the company can go public, also called the IPO. This is often an exit strategy for founders. They can cash in on their company shares and move on to their next project.

Bootstrapping

A startup isn’t required to seek funding. Many startups become successful by bootstrapping, which is starting a business with no outside funding. With bootstrapping, the founders start the business with their own personal funds.

Taking no outside investment causes the startup to have slower growth because the startup has to re-invest profits. Many founders prefer to bootstrap because they maintain complete control of the startup. Additionally, it’s often more lucrative to the founders because they maintain ownership of all of the shares of the company.

Equity-based Crowdfunding

A newer form of raising money for startups is equity-based crowdfunding. Founders can skip the lengthy and time-consuming process of pitching to individual investors and pitch their business online to thousands of investors at one time. A startup can raise up to $50 million on an equity crowdfunding platform like Start Engine.

Why Startups Fail—and Succeed

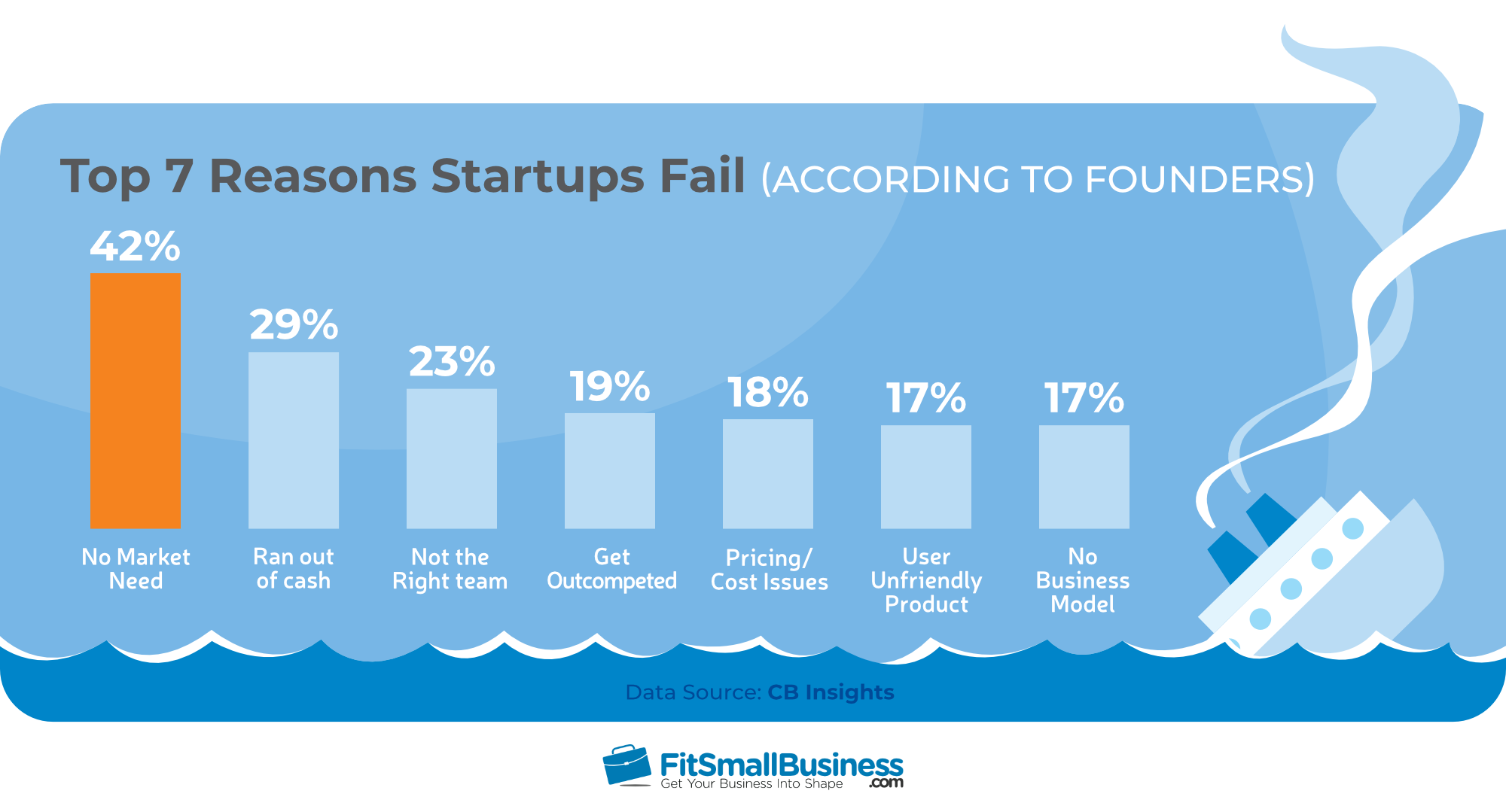

A lack of funds can be the end of a startup—and nearly 90% of startups fail. However, funding isn’t the No. 1 reason most startups don’t make it. A survey of 101 startup founders said the reason they failed was that there wasn’t a market need.

Percentages are high because founders attributed multiple reasons to their failure.

(It’s important to note that many of the reasons given above could be a result of cognitive dissonance, which is the changing of reality to fit conflicting beliefs. For example, maybe a company ran out of cash because no one wanted to purchase the product, however, the founder doesn’t want to admit that specific failure, so they blame failure on a lack of cash.).

But before you fall into a pit of despair, you should know it’s not all bad and startups that thrive also share some traits. American businessman and investor Bill Gross has identified one main reason high-growth startups succeed: Timing.

The 2008 recession, Gross argues, may have helped companies like Airbnb and Uber succeed. During the recession, people were desperate to make extra money. The need to make money increased the likelihood someone was willing to rent out their home to strangers, or let strangers into their car.

If Airbnb or Uber were to start in a growing and secure economy, they may have failed.

Lifecycle of a Successful High Growth Startup

There are no rules on what to do once a startup becomes successful. Typically there’s an exit, such as an acquisition or an initial public offering (IPO). Success could also mean staying on to grow the startup after the IPO into a huge company, as Mark Zuckerberg did with Facebook.

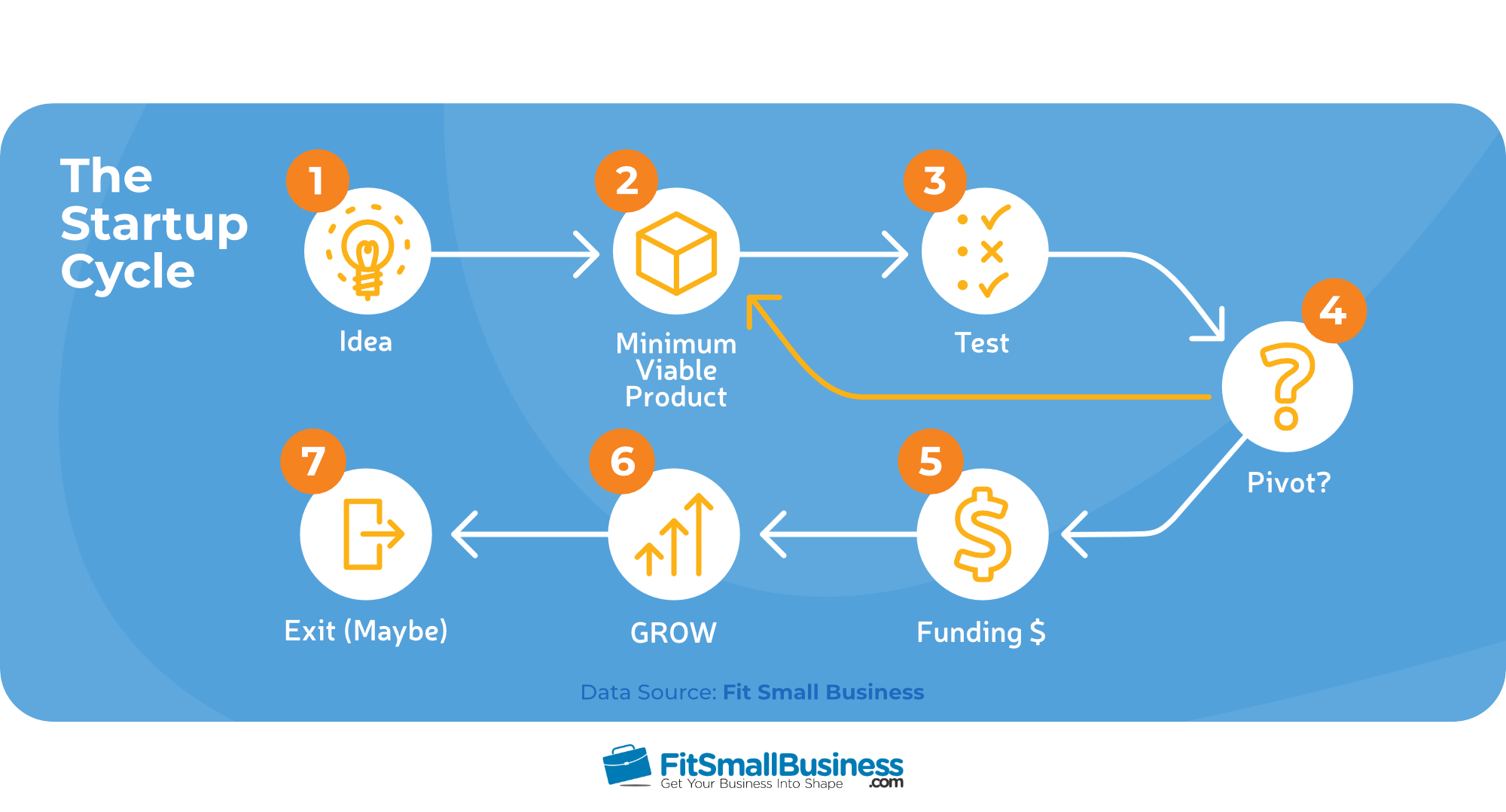

Even though there isn’t a defined path to creating a successful startup, many tend to follow a pattern.

- The startup begins with an idea, also thought of as a problem that needs to be solved.

- A product is created to solve the identified problem, which is called the minimum viable product (MVP). The MVP is a stripped-down version of the final product. Ideally, it should take less than six months to create an MVP. You don’t want to spend a lot of time on the MVP because there may be several iterations of the product. It’s best to make the simplest version of the product and move to step three.

“As you consider building your own minimum viable product, let this simple rule suffice: remove any feature, process, or effort that does not contribute directly to the learning you seek.”

—Eric Ries, Author, The Lean Startup

- Once you have the MVP, test the market by selling it to the first customers. As customers use the product, ask for feedback and make changes to the product.

- If the customers aren’t adopting the product, consider a pivot. A pivot is a change in the business strategy, business model, or product. For example, Instagram started as a mobile gaming check-in app. They didn’t gain traction with customers until they stripped the app of all its features, except the ability to add photos. Many businesses repeat the MVP, test, and pivot phase several times until they create an in-demand product.

- Once the startup has paying customers, it’s time to seek funding. You will find that money is needed to quickly grow and scale the startup to the billion-dollar company it’s destined to become. Seeking funding from investors is often a full-time job for one of the founders, and can take several months. A possible funding scenario is after giving dozens of pitches, several investors want to put a large amount of cash into the startup. The first round (Series A) of funding gives the startup over $1 million (and up to $150 million) to grow the company! The average startup raises $1.1 million in its Series A round of funding.

- With the additional funding, it’s time to grow the business. Spend the money raised on additional employees, marketers, servers, and whatever it takes to get as many customers as possible. As the business grows, there may be more pivots and more funding rounds, however, what’s most important is that the startup continues to grow.

- This final life cycle step is the success of the startup. Say, for instance, that after seven years of hard work, the startup is wildly successful. So successful that many are now considering it a company because it’s making over $100 million per year with 1,000 employees, and is valued at $3 billion. The initial public offering (IPO) is finally here. Now, with consistent revenue and a little profit, a big decision needs to be made: Sell your shares for a $200 million personal profit and move on to the next project? Or stay and grow the company to a $10 billion valuation?

The startup lifecycle helps you understand the different phases of a startup. It’s also important to know what separates a startup from other types of businesses.

Difference Between a Startup and Other Businesses

Depending on who you’re talking to, the word startup gets used for several purposes. For example, the government-funded Small Business Administration uses the term to describe any business that’s been incorporated less than three years. However, as we said above, a true startup is laser focused on high growth.

“A startup is like a mosquito. A bear can absorb a hit, and a crab is armored against one, but a mosquito is designed for one thing: to score. No energy is wasted on defense. The defense of mosquitoes, as a species, is that there are a lot of them, but this is little consolation to the individual mosquito.”

— Paul Graham, Co-Founder, Y Combinator

Small Business

We love small businesses, but they should not be considered startups. The revenue growth for small business is small and consistent. Whereas startups are aiming for at least 100% growth every year. On average, small businesses grow revenue at around 3% a year.

Big Business

Big businesses differ from startups because it’s difficult for big businesses to innovate. This happens for a couple of reasons. One, talent gets attracted to startups because it can be more lucrative to work at a startup and it’s more likely ideas will be implemented. Two, it’s difficult for the average big business to pivot when the market demands it. Changing strategy in a nimble startup is like turning a speedboat, whereas a big business is like turning a Carnival cruise ship.

There may be teams within big businesses that try to operate like a startup; however, it’s still difficult to break through the bureaucracy and implement the team’s innovations.

Instead of innovating, big businesses acquire innovative companies. For instance, Facebook has spent over $23 billion acquiring over 70 companies, including WhatsApp for $19 billion and Instagram for $1 billion.

Lifestyle Business

The main difference between a startup and a lifestyle business is the amount of time spent on the business. Founders in a startup will work for as long as possible to make their startup a success. Elon Musk has worked 80 to 120 hour weeks and has slept on the factory floor to meet Tesla deadlines.

Although a founder of a lifestyle business may work long hours to get their business launched, a lifestyle business is created with the goal of a healthy work/life balance. Typically, lifestyle businesses enable the founder to travel while running their business. Examples of these businesses include blogging, consulting, freelancing services, and ecommerce drop shipping.

Social Business

Social Businesses (also called L3C or benefit corporations) are businesses with an expanded purpose beyond maximizing shareholder value. Examples of social businesses include Patagonia, Kickstarter, and King Arthur Flour.

While many startups are trying to make the world a better place through its innovative technology and software, the main goal is increasing revenue and profit, not social improvement.

The Wrap-up

So, what, exactly, is a startup? It’s a business hyper-focused on quick, big growth. It creates a product that disrupts an industry and possibly changes our day-to-day life.

Creating a startup can feel like an emotional roller coaster. No two founders experience a startup the same, however, a startup is defined by their shared experience. The excitement of coming up with an idea, fighting through the soul-crushing pit of despair, hoping that one day—finally—you’ve created a beautiful unicorn.

Read More

0 تعليقات